Councils collect just 25% of landlord fines

Property118

Councils collect just 25% of landlord fines

Councils in England have collected only a quarter of the civil penalties issued to landlords for housing offences over the past two years, research reveals.

The National Residential Landlords Association says its data was obtained through Freedom of Information requests to English councils responsible for PRS enforcement.

Across 2023/24 and 2024/25, 285 councils imposed almost £30 million in civil penalties on private landlords.

Just under £7.5 million of that total was actually recovered.

Fed-up responsible landlords

The NRLA’s chief executive, Ben Beadle, said: “Tenants and the vast majority of responsible landlords will rightly be fed up with our findings.

“For too long a minority of rogue and criminal operators have allowed to act with impunity, bringing the sector into disrepute.

“It is galling then to see that those breaking the law are still failing to pay the price – leaving good landlords to pick up the tab in licensing fees.”

He added: “This also raises serious questions about how ready councils are to enforce the Renters’ Rights Act, and about the adequacy of the upfront funding provided to them to support enforcement action.”

RRA implemented in May

The NRLA says that the same records show that nearly 3,700 civil penalties were issued to landlords during the two-year period.

Its research has been published ahead of the Renters’ Rights Act coming into force on 1 May.

Under the legislation, the maximum civil penalty available to councils will increase from £7,000 to £40,000.

According to the NRLA, the figures indicate that councils are not collecting funds that could otherwise be used to support enforcement activity in the private rented sector.

Examine council enforcement funding

The organisation says the issue raises questions about how local authorities will enforce the new regime once the higher civil penalties become available.

Alongside the research, the NRLA is calling for the creation of a new Chief Environmental Health Officer post with a national remit for improving enforcement standards.

It is also urging the government to undertake a full assessment of the resources currently available to local authority enforcement teams.

It says an analysis of the funding they will require to enforce the Renters’ Rights Act is needed.

The organisation also says councils should be required to publish an annual report setting out enforcement activity relating to the PRS in their area.

The post Councils collect just 25% of landlord fines appeared first on Property118.

View Full Article: Councils collect just 25% of landlord fines

Landlords told not to wait until Decent Homes Standard to fix rental homes

Property118

Landlords told not to wait until Decent Homes Standard to fix rental homes

The government insists private landlords must not wait until the Decent Homes Standard 2035 deadline to improve rental properties.

Under the Decent Homes Standard, landlords will need to meet certain criteria, including that homes must be in a reasonable state of repair and provide core facilities and services, including a kitchen with adequate space and layout, an appropriately located bathroom and WC, and adequate protection from external noise.

A government document says homes must also be equipped with child-resistant window restrictors and provide a reasonable degree of thermal comfort.

Should not wait until 2035 deadline

In a written question, Labour MP Vicky Foxcroft asked the government: “Whether it has an assessment of the potential merits of expediting implementation of the Decent Homes Standard to improve maintenance practices in privately rented properties.”

In response, Housing Minister Matthew Pennycook claimed landlords must improve rental properties before the 2035 deadline.

He said: “Private rented sector landlords should address non-decency wherever it exists. While we are giving landlords until 2035 to implement our new Decent Homes Standard, we have made clear they should not wait until 2035 to improve their properties.

“We are also acting in other ways to ensure private tenants have safe, warm, and decent homes, including introducing new Minimum Energy Efficiency Standards for the sector; strengthening local authority enforcement in respect of unremedied hazards; and applying Awaab’s Law Act to the private rented sector through the relevant provisions in the Renters’ Rights Act.”

The government have previously claimed “too many tenants are living in poor quality housing”, with 21% of homes in the Private Rented Sector (PRS) and 10% of homes in the social rented sector failing to meet the Decent Homes Standard.

The post Landlords told not to wait until Decent Homes Standard to fix rental homes appeared first on Property118.

View Full Article: Landlords told not to wait until Decent Homes Standard to fix rental homes

Why Many Investors Stay Busy But Do Not Build Real Wealth

Property118

Why Many Investors Stay Busy But Do Not Build Real Wealth

Many investors never ask themselves an important question. What if this year ends up looking exactly like the last one financially?

Not terrible. Not amazing. Just the same.

You worked hard, stayed busy and maybe even made investments. Yet when you step back and look at the results, progress often feels slower than it should.

One common reason is relying on a single strategy to do everything.

The investors who build lasting wealth usually take a different approach. They understand that different assets serve different roles.

The Three Roles Behind Wealth Building

Successful investors tend to focus on three key areas.

Income

Assets that generate regular cash flow provide stability and support your lifestyle.

Growth

Other assets increase in value over time, building long term wealth.

Compounding capital

Protecting and multiplying the capital you already have allows wealth to grow faster over time.

When these three elements work together, progress begins to accelerate.

Where Most People Get Stuck

Most people become reasonably good at making money.

Some learn how to keep more of it.

But far fewer understand how to multiply what they keep.

Without that third step, investors often find themselves working harder each year while their financial progress remains slow.

Working Hard Is Not Always Enough

Many investors stay extremely busy with deals, calls and opportunities.

But activity does not always equal progress.

The real shift happens when investors focus not just on earning more, but on building systems that grow their wealth over time.

When income, growth and compounding are aligned, wealth building stops feeling random and starts gaining momentum.

Want to learn how this works in practice?

Simon Zutshi will be explaining this in more detail during a live online webinar on Wednesday 11th March.

During the session, he will break down the three assets that build real wealth, how they work together, and how investors can position themselves to grow their wealth more effectively.

Book your place on the webinar here.

The post Why Many Investors Stay Busy But Do Not Build Real Wealth appeared first on Property118.

View Full Article: Why Many Investors Stay Busy But Do Not Build Real Wealth

Section 24 timeline of how the debate unfolded

Property118

Section 24 timeline of how the debate unfolded

In 2015, months before Section 24 became law, Property118 founder Mark Alexander met officials at HM Treasury responsible for the policy and raised concerns about how landlords might restructure their businesses if the new tax rules made existing models commercially unviable.

The discussion included reference to the Elizabeth Moyne Ramsay case and the potential relevance of Section 162 incorporation relief, a statutory provision allowing a genuine business to transfer its assets to a company without an immediate capital gains tax charge.

The point is not that policymakers endorsed any particular restructuring approach. The point is that the structural consequences of Section 24 were being raised openly with officials while the legislation was still moving through Parliament.

The timeline below sets out how the debate unfolded.

July 2015: the Summer Budget announcement

On 8 July 2015 the government announced a major change to the tax treatment of finance costs for individual landlords. The policy replaced the deduction of mortgage interest with a basic rate tax credit.

For landlords with higher borrowing levels, the immediate concern was clear. Tax could be calculated on income before interest costs were fully deducted.

The parliamentary record of the announcement can be read in Hansard: Summer Budget 2015 – Hansard record

Summer 2015: the sector begins analysing the consequences

The announcement triggered immediate debate across the property industry. Landlords, accountants and advisers began examining how the policy would interact with existing tax legislation.

Property118 quickly became one of the platforms where landlords were openly discussing the implications of the policy and analysing possible responses.

Those discussions included the Elizabeth Moyne Ramsay case and the question of whether property letting activity could constitute a business for tax purposes, an issue closely linked to the availability of Section 162 incorporation relief.

Examples of those early discussions can still be seen in the comment threads responding to the Summer Budget announcement: Summer Budget 2015: landlord reactions on Property118

September 2015: meeting with Treasury officials responsible for the policy

By September 2015 the debate had moved beyond commentary. Mark Alexander attended a meeting at HM Treasury to discuss the practical implications of Section 24.

The meeting involved two officials working on the policy affecting residential landlords:

Megan Shaw, an HMRC policy lead responsible for the residential property finance cost changes introduced through the Finance (No.2) Act 2015.

Sean Rath, a tax policy official involved in the development of legislation during that period.

Alexander says the discussion included the Elizabeth Moyne Ramsay case and the relevance of Section 162 incorporation relief for landlords who might need to reorganise their businesses if the economics of operating personally changed.

A contemporaneous reference to the meeting can still be found in the Property118 comment archive: Property118 comment referencing the Treasury meeting with Sean Rath and Megan Shaw

Independent context for Megan Shaw’s role can also be seen in a professional tax body publication describing her as HMRC policy lead for the Finance (No.2) Act 2015 residential property finance cost changes: ATT Property Tax Voice – December 2015

October 2015: meeting with George Freeman MP

On 2 October 2015 Alexander met George Freeman MP and later published a summary of the discussion.

In that article he also recorded that he had already met Megan Shaw and Sean Rath at the Treasury while preparing briefings on the policy implications.

My meeting with George Freeman MP – Property118

2015: landlord evidence submitted to Parliament

During scrutiny of the Finance Bill introducing Section 24, written evidence submitted to the Public Bill Committee included contributions linked to Property118 participants.

The evidence included examples based on information said to have been received by Megan Shaw at HMRC, illustrating how the policy might affect landlords in practice.

Finance Bill Committee written evidence (FB04)

2015–2016: HMRC policy papers acknowledge potential incorporation

When the government introduced the finance cost restriction for landlords, HMRC also published a Tax Information and Impact Note explaining how the policy might affect behaviour within the private rented sector. Such documents are designed to assess how taxpayers may respond to new legislation.

In this case HMRC acknowledged that some landlords might change the structure of their property businesses, including the possibility of operating through companies rather than personally.

This observation appeared in the official policy paper accompanying the legislation:

Income Tax: restriction of finance cost relief for landlords – HMRC policy paper

The significance of this document is straightforward. It demonstrates that the potential for structural changes within the landlord sector was recognised by HMRC itself during the introduction of Section 24. In other words, the possibility that landlords might reorganise their businesses, including through incorporation, was not an unforeseen development. It was part of the policy context from the beginning.

2017 to 2020: Section 24 phased into full effect

The mortgage interest restriction was implemented gradually over four tax years. The first stage took effect in April 2017, with further reductions in allowable finance cost deductions each year.

By April 2020 the new system was fully in place, with finance costs replaced entirely by a basic rate tax credit.

2017: Office of Tax Simplification examines landlord incorporation

As the impact of Section 24 began to emerge, the Office of Tax Simplification (OTS) examined the taxation of property income and the behavioural responses landlords were considering.

In its review the OTS noted that the restriction on finance cost relief had created a significant incentive for some landlords to consider operating through companies rather than personally.

The report recognised that incorporation was becoming an increasingly discussed structural response within the sector.

Office of Tax Simplification – Review of the taxation of property income

The OTS analysis confirmed that the restructuring implications of Section 24 were not theoretical. They were already influencing how landlords were thinking about the future structure of their businesses.

HMRC GAAR guidance: choosing between statutory tax structures

UK tax law also recognises that taxpayers may legitimately organise their affairs using the framework created by Parliament.

HMRC’s own General Anti-Abuse Rule guidance explains that choosing between different statutory tax treatments is not, in itself, abusive.

Part D 2.2 of the GAAR guidance describes this principle as “Legislative Choice”, explaining that taxpayers are entitled to choose between alternative tax outcomes created by legislation.

HMRC GAAR guidance – Part D2.2 Legislative Choice

This principle reflects a simple point. Where Parliament provides a statutory framework, including reliefs such as incorporation relief, taxpayers are entitled to operate within that framework when organising genuine commercial activities.

2022: the OTS reviews residential landlords, and the incorporation trend is part of the context

By 2022, the incorporation question had moved from industry debate into mainstream policy review.

On 1 November 2022 the Office of Tax Simplification published its Property income review: Simplifying income tax for residential landlords, a wide-ranging review of how residential property income is structured and taxed, including sections on ownership and financing.

The report does not present incorporation as a loophole. It treats the difference between personal and corporate ownership as part of the landscape landlords have to navigate, including the fact that companies and individuals are taxed under different rules for finance costs following the introduction of Section 24.

OTS Property income review (HTML on GOV.UK)

OTS Property income review (PDF)

Professional commentary published shortly after the report made the point explicitly, noting that the tax rules have led to increasing numbers of corporate owners. That matters because it supports the obvious conclusion that incorporation became a recognised behavioural response to the post-Section 24 tax framework, not a later invention.

Why this timeline matters

This chronology shows that the restructuring implications of Section 24 were foreseeable and were being discussed from the moment the policy was announced.

Those discussions were not hidden. They took place in public commentary, in parliamentary evidence and in meetings with policymakers while the legislation was still being developed.

The purpose of setting out the timeline is not to claim that policymakers endorsed any particular approach. It is simply to show that the structural consequences of Section 24 were raised openly and transparently from the beginning.

The post Section 24 timeline of how the debate unfolded appeared first on Property118.

View Full Article: Section 24 timeline of how the debate unfolded

Government defends EPC standards claiming they help landlords and tenants

Property118

Government defends EPC standards claiming they help landlords and tenants

The government claims energy performance certificate (EPC) standards are “proportional” to landlords and tenants.

In a written question, Plaid Cymru MP Llinos Medi, asked whether the government would consider the impact of proposed changes to the landlord cost cap and exemptions for Welsh private renters

The news comes as the government announced all private landlords in England and Wales will need to meet EPC C targets by 2030.

Manage the burden placed on landlords

Plaid Cymru MP Llinos Medi asked: “To ask the Secretary of State for Energy Security and Net Zero, what assessment his Department has made of the potential impact of lowering the landlord cost cap and introducing low property value exemptions for minimum energy efficiency standards on private renters in Wales.”

In response, Martin McCluskey, minister for energy consumers, claimed the government’s energy-efficiency standards were fair to landlords and tenants.

He said: “The government’s response to the consultation on increasing the minimum energy efficiency standard for private rented homes was accompanied by the Department’s Impact Assessment. The assessment provides an estimated impact of the final policy based on a range of data available, including HM Land Registry and property price data available for Wales.

“The measures included in the final policy are intended to be proportional to help manage the burden placed on landlords and the impact on the rental market, whilst still delivering improved, warmer, cheaper to heat homes for private rented sector tenants.”

Under government plans, landlords will be able to choose between the smart or heat metrics, and the cap on the amount they are expected to invest to meet the new standards will be reduced from £15,000 to £10,000.

The cost cap will be lower where £10,000 would represent 10% or more of a property’s value.

Any spending on energy-efficiency works carried out since October last year will also count towards the planned cap, and the government will deliver a range of finance options, including Boiler Upgrade Scheme (BUS) grants.

The post Government defends EPC standards claiming they help landlords and tenants appeared first on Property118.

View Full Article: Government defends EPC standards claiming they help landlords and tenants

Rent arrears and claim values fall despite rise in cases

Property118

Rent arrears and claim values fall despite rise in cases

The average value of rent arrears fell to £1,980 in 2025, down from £2,143 in 2024, according to new data from Reposit.

It also says that claim values also declined over the same period, dropping from £1,207 to £1,178, a reduction of just over 2%.

However, while the monetary value of arrears and claims fell, the frequency of cases increased across the year.

Also, more tenants fell into financial difficulty last year, but the debt recorded in each case was lower than in 2024.

Arrears value falls

The ‘no deposit’ platform’s chief executive, Ben Grech, said: “It’s encouraging to see the average value of arrears and claims falling.

“However, the marginal rise in case volumes shows that financial pressure across the sector remains.

“At the same time, the Renters’ Rights Act is creating a more complex operating environment for landlords, fundamentally changing how arrears and repossessions are managed.”

He added: “With the abolition of Section 21, many landlords are understandably becoming more cautious in their approach to rent arrears.”

Tenant deposit not enough

Mr Grech went on to say that the average cash deposit is now £1,296, which is £629 below the average arrears value.

That shortfall, he warns, highlights the limitations of traditional five-week deposits which don’t provide adequate protection when arrears escalate.

He said: “As a result, we’re seeing growing demand for deposit solutions that offer greater financial protection for landlords and are FCA-regulated, while also reducing compliance risk for agents in light of the new regulations.”

UK rents rose

The firm is pointing to Office for National Statistics (ONS) figures which show average UK monthly rents rose by 4% to £1,368 in the 12 months to December 2025.

That compares with annual growth of 4.4% in the year to November.

UK Finance also reported 9,520 buy to let mortgages were in arrears of 2.5% or more in Q4 2025, 9% fewer than in the previous quarter.

During the same period, 770 BTL properties were taken into possession, down 14%.

The post Rent arrears and claim values fall despite rise in cases appeared first on Property118.

View Full Article: Rent arrears and claim values fall despite rise in cases

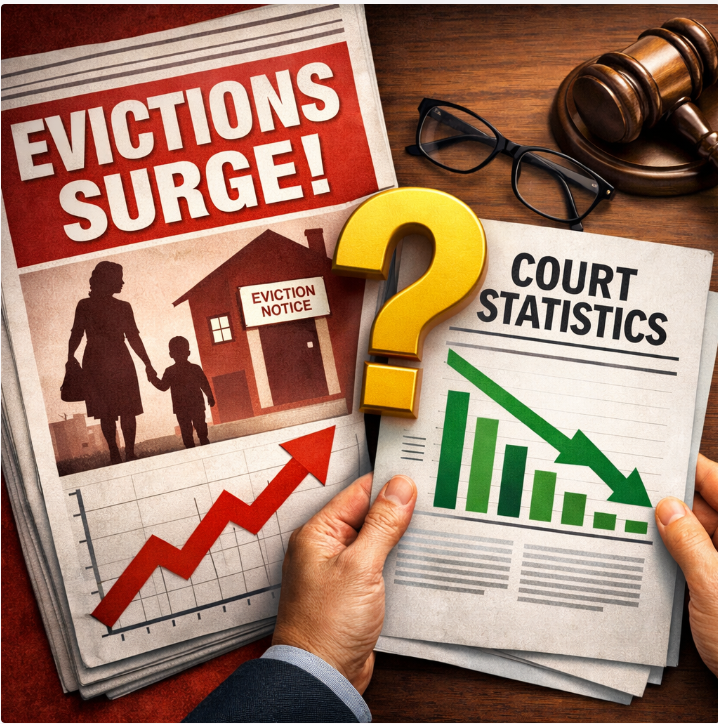

Evictions ‘surging’? The court data tells a very different story

Property118

Evictions ‘surging’? The court data tells a very different story

Claims that evictions are “surging” have become a familiar feature of the housing debate. Campaign groups repeat them in press releases, journalists reproduce them in headlines, and the figures quickly take on a life of their own.

The problem is that eviction statistics are often presented in a way that sounds dramatic but does not fully explain what the numbers actually measure.

When the full set of court data is examined, the picture becomes far more nuanced. In fact, the latest official figures suggest that fewer eviction cases were started in 2025 than in the previous year, even though some enforcement activity increased.

Understanding why requires a look at how eviction statistics are recorded in the first place.

If the eviction crisis narrative were correct, possession claims should be rising. The official statistics show they are not.

The eviction pipeline most headlines ignore

The Ministry of Justice publishes quarterly possession statistics covering England and Wales. These figures track the progress of eviction cases through the court system.

There are four key stages:

- Possession claim issued

- Possession order granted

- Warrant issued

- Repossession carried out by county court bailiffs

Each stage represents a different step in the legal process.

The important point is that cases take time to move through this pipeline. A landlord might issue a possession claim today, but the final repossession could take many months to reach the statistics.

According to the Ministry of Justice, the median time from claim to repossession is now roughly 27 weeks, and that does not include the notice period that precedes a court claim.

In other words, eviction statistics are not a single moment in time. They are the outcome of decisions taken many months earlier.

What the latest data actually shows

When the official figures are examined across the whole pipeline, an interesting pattern emerges.

In 2025:

- Possession claims fell compared with 2024, meaning fewer new eviction cases entered the courts.

- Possession orders and warrants also declined.

- Bailiff repossessions increased slightly in some quarters.

At first glance that combination can look contradictory. If repossessions are rising, surely that must mean landlords are evicting more tenants, but in reality, the statistics suggest something quite different. When early stages of the pipeline fall but the final stage rises, the usual explanation is that courts are enforcing older cases that were already in the system. The repossessions recorded today often reflect claims issued six to nine months earlier.

The statistical illusion behind eviction headlines

This timing effect creates a statistical illusion.

Campaign groups and media reports often focus on the final stage of the process, bailiff repossessions, because it represents the moment a tenant actually leaves the property.

Those numbers can rise even while the number of new eviction cases is falling.

That distinction is rarely explained in headlines, yet it is crucial for understanding what is really happening in the private rented sector.

Possession claims are the leading indicator of landlord behaviour; they show when landlords begin eviction proceedings.

Repossessions are a lagging indicator, reflecting decisions made months earlier.

When fewer claims are being issued but repossessions increase slightly, it normally indicates a backlog of older cases being completed rather than a surge in new eviction activity.

Where the Renters’ Rights Act fits in

The timing of the latest statistics also overlaps with the period following Royal Assent of the Renters’ Rights Act. Some commentators have suggested that landlords may be rushing to evict tenants before the reforms take effect. That behaviour may exist in individual cases, but the broader court data does not yet show a wave of new eviction claims entering the system. If anything, the opposite pattern appears in the figures for 2025.

Looking beyond the headlines

None of this means that eviction is not a serious issue for the households affected. Losing a home is always disruptive and distressing. What it does mean is that the statistics deserve careful interpretation.

Housing debates are often shaped by powerful narratives. Yet when the full dataset is examined, the picture can look very different from the headline version.

The most revealing indicator is not how many repossessions happened at the end of the process, but how many new cases entered the courts in the first place. In 2025, that number went down.

When fewer eviction cases are entering the courts but more older cases are being enforced, the statistics can easily create the impression of a surge even when the underlying pipeline is shrinking.

That leaves an obvious question. If the eviction crisis narrative were accurate, why are fewer new possession claims entering the court system?

Are eviction statistics being misunderstood, selectively presented, or deliberately framed to create a more dramatic picture than the full dataset supports?

Property118 readers are well used to scrutinising housing policy claims, so how do you interpret the figures?

Support Property118 and keep the platform independent

If you value evidence-led reporting like this, you can support the work here.

Monthly support helps fund independent reporting, research, and the free landlord forum.

The post Evictions ‘surging’? The court data tells a very different story appeared first on Property118.

View Full Article: Evictions ‘surging’? The court data tells a very different story

Problem tenants can actually help you sell faster: how changing the narrative can get the highest prices for your properties

Property118

Problem tenants can actually help you sell faster: how changing the narrative can get the highest prices for your properties

We’ve all been there, most landlords think a “difficult” tenant kills a sale. But in reality, handled correctly, they can help drive the price up.

Amidst the noise, the regulation changes, the red tape and the headlines predicting doom and gloom, landlords across the North West are still selling. And not only selling, but selling quickly, at strong prices, with complete certainty.

Right now, despite the Renters’ Right Act creeping in, we’re seeing buy-to-let properties and portfolios sit stagnant on the market for months with unrealistic asking prices. Why? Landlords are holding out for yesterday’s market. Others are paralysed by compliance worries, damp reports, and in the worst cases: tenants.

Meanwhile, for the 80 landlords per week coming to us to sell, they’re exiting cleanly and profitably.

At Landlord Sales Agency, we specialise exclusively in helping motivated landlords sell, particularly those with freehold houses across the North West, where demand remains strong and buyer appetite is rising.

Unlike traditional agents who inflate asking prices to win your instruction, we position properties strategically to draw serious buyers in. Lower, intelligent pricing creates urgency. Urgency creates multiple offers. Multiple offers create bidding wars, and bidding wars push prices up. What’s more, we move fast. Super fast. All our properties sell on average in under 28 days.

But what if you have tenants who won’t allow access? Perhaps you have tenants that are determined to stay, or feel anxious about viewings?

Recently, a landlord approached us with properties to sell in St Helens, and one in particular looked, on paper, impossible. The tenants were determined to remain in situ and initially refused access for viewings. Many landlords would have backed away or entered into conflict, many estate agents or auctions would be up against it, bracing for the process to take months.

But at Landlord Sales Agency, we know exactly how to deal with tenants. In fact, getting them to come on side is one of the things we do best.

Through careful communication and our team of experts who specialise in conflict resolution, we discovered the tenants had already identified a potential buyer two doors down who’d be interested in keeping them on. That vital piece of information, from getting the tenants to open up, was the catalyst to the sale.

We jumped on it straight away, welcoming the potential buyer into the property. But it wasn’t straightforward. At first, the tenants wouldn’t let anyone else in for viewings whilst they had this buyer lined up, but we knew how to make them feel at ease, allowing access and in turn pushing the price up by letting other buyers compete in a bidding war. The result was a huge success. The property sold to the buyer the tenants wanted, at the price the landlord wanted, and everyone was happy.

This isn’t just a one-off. We do this time and time again. And we’re the best in the UK to do it. No other company is getting tenants to work with them in the way we’re doing it. At Landlord Sales Agency, we’re working alongside tenants to not only get properties sold, but to leverage their local connections to get the properties sold for a price even higher than expected.

It’s why finding the right company to sell your properties matters more than anything else. And we’re the ones delivering.

Whilst landlords still need to be realistic on price – we typically achieve between 85 and 90% market value – our results significantly outperform auctions or estate agents while still delivering speed and certainty. It’s no coincidence that’s linked to a strategically lower listing price. And because we manage everything, from compliance updates to identifying what truly needs refurbs or repairing and what doesn’t, landlords avoid wasting money and go straight to the sale.

Money in the bank. No fuss. No hassle. No fees. No problem.

So if you have properties situated in the North West that are freehold houses around the £200k mark, with or without tenants, we’re ready to sell them.

There’s still a strong window of opportunity in this market, but the time to act is now.

/* “function”==typeof InitializeEditor,callIfLoaded:function(o){return!(!gform.domLoaded||!gform.scriptsLoaded||!gform.themeScriptsLoaded&&!gform.isFormEditor()||(gform.isFormEditor()&&console.warn(“The use of gform.initializeOnLoaded() is deprecated in the form editor context and will be removed in Gravity Forms 3.1.”),o(),0))},initializeOnLoaded:function(o){gform.callIfLoaded(o)||(document.addEventListener(“gform_main_scripts_loaded”,()=>{gform.scriptsLoaded=!0,gform.callIfLoaded(o)}),document.addEventListener(“gform/theme/scripts_loaded”,()=>{gform.themeScriptsLoaded=!0,gform.callIfLoaded(o)}),window.addEventListener(“DOMContentLoaded”,()=>{gform.domLoaded=!0,gform.callIfLoaded(o)}))},hooks:{action:{},filter:{}},addAction:function(o,r,e,t){gform.addHook(“action”,o,r,e,t)},addFilter:function(o,r,e,t){gform.addHook(“filter”,o,r,e,t)},doAction:function(o){gform.doHook(“action”,o,arguments)},applyFilters:function(o){return gform.doHook(“filter”,o,arguments)},removeAction:function(o,r){gform.removeHook(“action”,o,r)},removeFilter:function(o,r,e){gform.removeHook(“filter”,o,r,e)},addHook:function(o,r,e,t,n){null==gform.hooks[o][r]&&(gform.hooks[o][r]=[]);var d=gform.hooks[o][r];null==n&&(n=r+”_”+d.length),gform.hooks[o][r].push({tag:n,callable:e,priority:t=null==t?10:t})},doHook:function(r,o,e){var t;if(e=Array.prototype.slice.call(e,1),null!=gform.hooks[r][o]&&((o=gform.hooks[r][o]).sort(function(o,r){return o.priority-r.priority}),o.forEach(function(o){“function”!=typeof(t=o.callable)&&(t=window[t]),”action”==r?t.apply(null,e):e[0]=t.apply(null,e)})),”filter”==r)return e[0]},removeHook:function(o,r,t,n){var e;null!=gform.hooks[o][r]&&(e=(e=gform.hooks[o][r]).filter(function(o,r,e){return!!(null!=n&&n!=o.tag||null!=t&&t!=o.priority)}),gform.hooks[o][r]=e)}});

/* ]]> */

Contact Landlord Sales Agency

/* = 0;if(!is_postback){return;}var form_content = jQuery(this).contents().find(‘#gform_wrapper_515′);var is_confirmation = jQuery(this).contents().find(‘#gform_confirmation_wrapper_515′).length > 0;var is_redirect = contents.indexOf(‘gformRedirect(){‘) >= 0;var is_form = form_content.length > 0 && ! is_redirect && ! is_confirmation;var mt = parseInt(jQuery(‘html’).css(‘margin-top’), 10) + parseInt(jQuery(‘body’).css(‘margin-top’), 10) + 100;if(is_form){jQuery(‘#gform_wrapper_515′).html(form_content.html());if(form_content.hasClass(‘gform_validation_error’)){jQuery(‘#gform_wrapper_515′).addClass(‘gform_validation_error’);} else {jQuery(‘#gform_wrapper_515′).removeClass(‘gform_validation_error’);}setTimeout( function() { /* delay the scroll by 50 milliseconds to fix a bug in chrome */ }, 50 );if(window[‘gformInitDatepicker’]) {gformInitDatepicker();}if(window[‘gformInitPriceFields’]) {gformInitPriceFields();}var current_page = jQuery(‘#gform_source_page_number_515′).val();gformInitSpinner( 515, ‘https://www.property118.com/wp-content/plugins/gravityforms/images/spinner.svg’, true );jQuery(document).trigger(‘gform_page_loaded’, [515, current_page]);window[‘gf_submitting_515′] = false;}else if(!is_redirect){var confirmation_content = jQuery(this).contents().find(‘.GF_AJAX_POSTBACK’).html();if(!confirmation_content){confirmation_content = contents;}jQuery(‘#gform_wrapper_515′).replaceWith(confirmation_content);jQuery(document).trigger(‘gform_confirmation_loaded’, [515]);window[‘gf_submitting_515′] = false;wp.a11y.speak(jQuery(‘#gform_confirmation_message_515′).text());}else{jQuery(‘#gform_515′).append(contents);if(window[‘gformRedirect’]) {gformRedirect();}}jQuery(document).trigger(“gform_pre_post_render”, [{ formId: “515”, currentPage: “current_page”, abort: function() { this.preventDefault(); } }]); if (event && event.defaultPrevented) { return; } const gformWrapperDiv = document.getElementById( “gform_wrapper_515″ ); if ( gformWrapperDiv ) { const visibilitySpan = document.createElement( “span” ); visibilitySpan.id = “gform_visibility_test_515″; gformWrapperDiv.insertAdjacentElement( “afterend”, visibilitySpan ); } const visibilityTestDiv = document.getElementById( “gform_visibility_test_515″ ); let postRenderFired = false; function triggerPostRender() { if ( postRenderFired ) { return; } postRenderFired = true; gform.core.triggerPostRenderEvents( 515, current_page ); if ( visibilityTestDiv ) { visibilityTestDiv.parentNode.removeChild( visibilityTestDiv ); } } function debounce( func, wait, immediate ) { var timeout; return function() { var context = this, args = arguments; var later = function() { timeout = null; if ( !immediate ) func.apply( context, args ); }; var callNow = immediate && !timeout; clearTimeout( timeout ); timeout = setTimeout( later, wait ); if ( callNow ) func.apply( context, args ); }; } const debouncedTriggerPostRender = debounce( function() { triggerPostRender(); }, 200 ); if ( visibilityTestDiv && visibilityTestDiv.offsetParent === null ) { const observer = new MutationObserver( ( mutations ) => { mutations.forEach( ( mutation ) => { if ( mutation.type === ‘attributes’ && visibilityTestDiv.offsetParent !== null ) { debouncedTriggerPostRender(); observer.disconnect(); } }); }); observer.observe( document.body, { attributes: true, childList: false, subtree: true, attributeFilter: [ ‘style’, ‘class’ ], }); } else { triggerPostRender(); } } );} );

/* ]]> */

The post Problem tenants can actually help you sell faster: how changing the narrative can get the highest prices for your properties appeared first on Property118.

View Full Article: Problem tenants can actually help you sell faster: how changing the narrative can get the highest prices for your properties

Limited company landlords hold three times more properties

Property118

Limited company landlords hold three times more properties

Landlords using limited companies now control portfolios that are more than three times larger than those holding rented property in their own name, research reveals.

According to Pegasus Insight, this highlights a widening structural split across the private rented sector.

The data shows that 21% of landlords operate at least part of their portfolio through a limited company.

The firm’s latest Landlord Trends report indicates that incorporation has edged upward rather than accelerating sharply.

Limited company landlords hold an average of 15.9 properties, while individual landlords, by comparison, manage 4.9 on average.

Incorporated landlord portfolios

The firm’s founder and chief executive, Mark Long, said: “This isn’t about a sudden surge into incorporation, but about a steady structural divergence.

“Limited company landlords are operating at a different scale, with different funding models and different levels of engagement in the market.

“They tend to run larger, more leveraged and often more complex portfolios, which naturally creates a different risk profile and a different set of support needs.”

He added: “For lenders and policymakers, this is important, as it shows the PRS is no longer a single, uniform market.

“Ownership structure is becoming an increasingly important lens through which to understand landlord behaviour, resilience and even future supply.”

Rely on BTL finance

The research also shows that finance arrangements differ too with 69% of incorporated landlords are relying on buy to let mortgage borrowing.

For landlords holding personal assets, the ratio is 57%.

Also, 35% of limited company landlords own at least one House in Multiple Occupation, compared with 17% among individual landlords.

Work full or part-time

The firm has also found that among landlords operating through companies, 27% identify as full- or part-time.

For landlords holding property in their own name, the figure is 14%.

When it comes to setting rents, three quarters of limited company landlords increased rents in the past year, compared with 61% of individual landlords.

The post Limited company landlords hold three times more properties appeared first on Property118.

View Full Article: Limited company landlords hold three times more properties

After 30 Years in Property, One Strategy Still Leads for Cashflow

Property118

After 30 Years in Property, One Strategy Still Leads for Cashflow

Over three decades of investing have taught Simon Zutshi one clear lesson. If your goal is strong, consistent monthly income, not all strategies are equal.

Buy-to-lets can work. Flips can create chunks of cash. But when it comes to reliable cashflow, HMOs continue to stand out.

As the founder of property investors network, Simon has seen Houses of Multiple Occupation transform investors’ results when structured correctly

Why HMOs Can Be So Powerful

A standard rental property produces one stream of income.

An HMO produces several.

Multiple tenants under one roof means multiple rent payments. When sourced carefully, set up compliantly and managed professionally, this can significantly increase monthly cashflow compared to traditional single lets

For some investors, that uplift in income has meant replacing their employed earnings far sooner than expected

So Why Doesn’t Everyone Do Them?

Because most investors assume HMOs are too complicated

Licensing.

Planning.

Multiple tenants.

Management systems.

Yes, HMOs are more advanced.

But advanced does not mean impossible. It means structured.

With the right guidance, the process becomes clear. You understand the rules, the numbers and the risks before you commit. And you decide whether this strategy genuinely fits your goals.

Free 3 Part HMO Series

Rather than dismissing HMOs based on assumptions, Simon has created a free three-part video series explaining:

- Why HMOs can generate strong cashflow

- Why most investors avoid them

- How they can be funded, including approaches many overlook

- And how to decide if this strategy is right for you

The training is practical, direct and based on 30 years of real-world experience.

It is completely free to access.

If you are serious about building income from property in 2026 and beyond, this is an opportunity to properly understand one of the most powerful cashflow strategies available.

Do not rule it out without looking at it properly.

Register now and watch the free HMO video series before access closes.

The post After 30 Years in Property, One Strategy Still Leads for Cashflow appeared first on Property118.

View Full Article: After 30 Years in Property, One Strategy Still Leads for Cashflow

Categories

- Landlords (19)

- Real Estate (9)

- Renewables & Green Issues (1)

- Rental Property Investment (1)

- Tenants (21)

- Uncategorized (12,529)

Archives

- March 2026 (26)

- February 2026 (55)

- January 2026 (52)

- December 2025 (62)

- August 2025 (51)

- July 2025 (51)

- June 2025 (49)

- May 2025 (50)

- April 2025 (48)

- March 2025 (54)

- February 2025 (51)

- January 2025 (52)

- December 2024 (55)

- November 2024 (64)

- October 2024 (82)

- September 2024 (69)

- August 2024 (55)

- July 2024 (64)

- June 2024 (54)

- May 2024 (73)

- April 2024 (59)

- March 2024 (49)

- February 2024 (57)

- January 2024 (58)

- December 2023 (56)

- November 2023 (59)

- October 2023 (67)

- September 2023 (136)

- August 2023 (131)

- July 2023 (129)

- June 2023 (128)

- May 2023 (140)

- April 2023 (121)

- March 2023 (168)

- February 2023 (155)

- January 2023 (152)

- December 2022 (136)

- November 2022 (158)

- October 2022 (146)

- September 2022 (148)

- August 2022 (169)

- July 2022 (124)

- June 2022 (124)

- May 2022 (130)

- April 2022 (116)

- March 2022 (155)

- February 2022 (124)

- January 2022 (120)

- December 2021 (117)

- November 2021 (139)

- October 2021 (130)

- September 2021 (138)

- August 2021 (110)

- July 2021 (110)

- June 2021 (60)

- May 2021 (127)

- April 2021 (122)

- March 2021 (156)

- February 2021 (154)

- January 2021 (133)

- December 2020 (126)

- November 2020 (159)

- October 2020 (169)

- September 2020 (181)

- August 2020 (147)

- July 2020 (172)

- June 2020 (158)

- May 2020 (177)

- April 2020 (188)

- March 2020 (234)

- February 2020 (212)

- January 2020 (164)

- December 2019 (107)

- November 2019 (131)

- October 2019 (145)

- September 2019 (123)

- August 2019 (112)

- July 2019 (93)

- June 2019 (82)

- May 2019 (94)

- April 2019 (88)

- March 2019 (78)

- February 2019 (77)

- January 2019 (71)

- December 2018 (37)

- November 2018 (85)

- October 2018 (108)

- September 2018 (110)

- August 2018 (135)

- July 2018 (140)

- June 2018 (118)

- May 2018 (113)

- April 2018 (64)

- March 2018 (96)

- February 2018 (82)

- January 2018 (92)

- December 2017 (62)

- November 2017 (100)

- October 2017 (105)

- September 2017 (97)

- August 2017 (101)

- July 2017 (104)

- June 2017 (155)

- May 2017 (135)

- April 2017 (113)

- March 2017 (138)

- February 2017 (150)

- January 2017 (127)

- December 2016 (90)

- November 2016 (135)

- October 2016 (149)

- September 2016 (135)

- August 2016 (48)

- July 2016 (52)

- June 2016 (54)

- May 2016 (52)

- April 2016 (24)

- October 2014 (8)

- April 2012 (2)

- December 2011 (2)

- November 2011 (10)

- October 2011 (9)

- September 2011 (9)

- August 2011 (3)

Calendar

Recent Posts

- Rent rises show regional split in February – ARLA Propertymark

- Landlords coming back to us: We’ll relocate your tenants and sell before May 1st for a higher price than the investor market

- Landlords face £470m rent arrears across England

- Landlords slow to sign up for Making Tax Digital as deadline nears

- Rents rise 2% across England – Goodlord

admin

admin