Can investors still make money from Buy to Let

Can investors still make money from investing in buy to let property with all the restrictions that have been placed on the industry?

In the recent budget announcement (2016) landlords could quite easily be left with a feeling that they have been targeted because of the previous Mortgage tax relief changes and investor Stamp Duty. Investors can no longer claim tax relief on all their mortgage interest payments, which means that if previously they were making a net profit of £10,000 per annum but was paying £5,000 in mortgage interest costs, they could wipe that off and only pay tax on the remaining £5,000. The changes mean that higher-rate taxpayers whose mortgage interest costs make up 75% or more of their rental income will see their profits completely wiped out.

It is understandable that both new and seasoned investors alike might be put off from investing in property. There are various solutions available that can help you maximise profits and ensure that you are getting the best value for money. Below are some suggestions that can help you make money in the buy to let property market.

Reduce the cost of purchasing a property

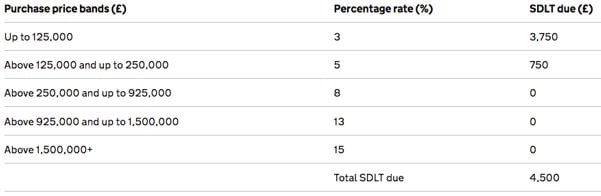

In April 2016 additional stamp duty charges were announced, which means that landlords must pay an extra 3% in stamp duty charges. With average house prices in the north west at £186k and west midlands at £213k according to Rightmove’s House Price Index, on a buy-to-let investment of £140,000 that means a whopping £4,500 in Stamp Duty.

https://www.tax.service.gov.uk/calculate-stamp-duty-land-tax/#/detail

Understandably, this has deterred investors from considering buy-to-let property, however there are alternative options that allow investors to mitigate their loss. Commercial property investments such as Care home investments and student property investments with values under £150,000, have NO stamp duty. Several investors are realising the benefits of these opportunities because the savings on Stamp Duty increases their yield on cost and ultimately the return on investment. Individuals have the potential to save thousands of pounds, simply by reconsidering the asset type they choose to own.

Research the most suitable areas for the asset class

The best areas for investment can be dependent upon the type of property you are wanting to purchase. For example, a sleepy town in the south west of England might be perfect for a care home investment, but not so suitable for a student accommodation investment.

For buy to let investments specifically, you should weigh up each area’s credentials in terms of its demographics, regeneration projects, vicinity to large cities (or whether the development is in a large city itself), transport links, employment options and comparable developments in the area. This research can be time consuming and for busy working professionals they find they cannot always afford the time to conduct such extensive research. Many employ the help of an investment company who have taken the leg work out of the research and who can provide guidance to investors.

Know the realistic rental yield that can be achieved

Achieving a good rental yield is a fine balancing act. For example, in London house prices are high so the average rental yield is around 4.4%. Compare that with the North West where property is typically cheaper and you are looking at returns of 6.4% on average, and according to Rightmove’s Rental Trends Tracker, Liverpool can achieve some of the highest yields in the country at 6.7%. This is all a balancing act though, as if you choose to buy a property at a rock-bottom price you may find that there is very little demand for the property, or that the rent generated from the property’s occupancy is disappointing. According to LendInvest, other areas that investors can expect a high yield include Peterborough, Stevenage and Rochester.

This leads us perfectly to our next point, which can have a knock-on effect with regards to how much rent per calendar month you can charge tenants.

Choose buy-to-let investments in areas experiencing regeneration

Investing in property in an area experiencing regeneration has many benefits, and one if which is that property prices are still reasonable but are predicted to increase in value once the regeneration is complete. This allows investors to either increase rent after a set period which has a knock-on effect on the annual rental yield, but it also means that they can sell on the property at a higher price, resulting in good capital uplift. The benefit of investing in an up-and-coming area is the increase in demand from young professionals, looking to move to the area in pursuit of fresh opportunities and jobs. Over the past twenty years, two London boroughs that have been particularly appealing to young professionals – Hackney and Haringey – have experienced the highest growth in terms of house prices at 749% and 544% respectively. They have all experienced regeneration and gentrification too, due to young professionals being priced out of the more expensive Shoreditch area.

Consider the condition of the property

Beautiful Georgian and Victorian buildings capture the hearts of most people. However, they are more likely to need significant repair work and care to make them attractive to the rental market. The cost that goes into renovating the development could seriously deplete profit margins, and may mean that the landlord will have to check up on the property and make improvements more often than with a new build. A building requiring a lot of maintenance will not only affect the rental yields, but also will mean that the investor would have to invest a significant amount of time to the property’s upkeep.

One Touch Property can help you take a decision on what would work best for your financial expectations. Whether it be a buy to let property investment or a different asset class, One Touch Property offers different types of investments to suit every individual’s needs.

jQuery(document).bind(‘gform_post_render’, function(event, formId, currentPage){if(formId == 403) {} } );jQuery(document).bind(‘gform_post_conditional_logic’, function(event, formId, fields, isInit){} ); jQuery(document).ready(function(){jQuery(document).trigger(‘gform_post_render’, [403, 1]) } );

The post Can investors still make money from Buy to Let appeared first on Property118.

View Full Article: Can investors still make money from Buy to Let

Post comment

Categories

- Landlords (19)

- Real Estate (9)

- Renewables & Green Issues (1)

- Rental Property Investment (1)

- Tenants (21)

- Uncategorized (12,483)

Archives

- February 2026 (35)

- January 2026 (52)

- December 2025 (62)

- August 2025 (51)

- July 2025 (51)

- June 2025 (49)

- May 2025 (50)

- April 2025 (48)

- March 2025 (54)

- February 2025 (51)

- January 2025 (52)

- December 2024 (55)

- November 2024 (64)

- October 2024 (82)

- September 2024 (69)

- August 2024 (55)

- July 2024 (64)

- June 2024 (54)

- May 2024 (73)

- April 2024 (59)

- March 2024 (49)

- February 2024 (57)

- January 2024 (58)

- December 2023 (56)

- November 2023 (59)

- October 2023 (67)

- September 2023 (136)

- August 2023 (131)

- July 2023 (129)

- June 2023 (128)

- May 2023 (140)

- April 2023 (121)

- March 2023 (168)

- February 2023 (155)

- January 2023 (152)

- December 2022 (136)

- November 2022 (158)

- October 2022 (146)

- September 2022 (148)

- August 2022 (169)

- July 2022 (124)

- June 2022 (124)

- May 2022 (130)

- April 2022 (116)

- March 2022 (155)

- February 2022 (124)

- January 2022 (120)

- December 2021 (117)

- November 2021 (139)

- October 2021 (130)

- September 2021 (138)

- August 2021 (110)

- July 2021 (110)

- June 2021 (60)

- May 2021 (127)

- April 2021 (122)

- March 2021 (156)

- February 2021 (154)

- January 2021 (133)

- December 2020 (126)

- November 2020 (159)

- October 2020 (169)

- September 2020 (181)

- August 2020 (147)

- July 2020 (172)

- June 2020 (158)

- May 2020 (177)

- April 2020 (188)

- March 2020 (234)

- February 2020 (212)

- January 2020 (164)

- December 2019 (107)

- November 2019 (131)

- October 2019 (145)

- September 2019 (123)

- August 2019 (112)

- July 2019 (93)

- June 2019 (82)

- May 2019 (94)

- April 2019 (88)

- March 2019 (78)

- February 2019 (77)

- January 2019 (71)

- December 2018 (37)

- November 2018 (85)

- October 2018 (108)

- September 2018 (110)

- August 2018 (135)

- July 2018 (140)

- June 2018 (118)

- May 2018 (113)

- April 2018 (64)

- March 2018 (96)

- February 2018 (82)

- January 2018 (92)

- December 2017 (62)

- November 2017 (100)

- October 2017 (105)

- September 2017 (97)

- August 2017 (101)

- July 2017 (104)

- June 2017 (155)

- May 2017 (135)

- April 2017 (113)

- March 2017 (138)

- February 2017 (150)

- January 2017 (127)

- December 2016 (90)

- November 2016 (135)

- October 2016 (149)

- September 2016 (135)

- August 2016 (48)

- July 2016 (52)

- June 2016 (54)

- May 2016 (52)

- April 2016 (24)

- October 2014 (8)

- April 2012 (2)

- December 2011 (2)

- November 2011 (10)

- October 2011 (9)

- September 2011 (9)

- August 2011 (3)

Calendar

Recent Posts

- London rents climb as supply stays tight

- Landlords devote 31 hours of ‘sweat’ every month to property management

- Social housing landlords urged to be fair on pet requests

- Derby landlord sells his portfolio with no searches, no survey, and £30,000 more than investor market

- Council urges landlords to help amid housing emergency in Scotland

admin

admin