Punishing private landlords – help or hindrance?

Everyone knows that rogue landlords bring down standards and should be rooted out, but have recent buy-to-let changes gone too far in punishing the good landlords who provide an excellent service and high-quality accommodation, as well as people who actively choose to rent not buy?

In the past eighteen months, the Government appears to have declared war against Britain’s estimated 1.8 million private landlords. Stamp duty has been put up, taxes have increased and the ever-changing rules and regulations have left many landlords confused and uninformed about their obligations. The outcome? Well, it’s still early days, but judging by the 49% fall in buy-to-let mortgage lending in the past year, I think it’s safe to say the market is shrinking.

One of the supposed driving forces behind the changes is to “level the playing field for homeowners and investors” by making buy-to-let less attractive, which in turn will create greater supply of properties for first-time buyers. But who is this assault on private landlords really helping…or more to my point, hindering?

To some people, getting that first step on the property ladder is very important and I agree that there should be more support in helping people achieve their home-owner aspirations. However, we must also remember that the private rented sector provides much-needed homes for those people who are not ready to buy, or quite simply do not want to purchase a property because they are happy having the flexibility of renting.

The UK has a lot more students, especially from overseas, who typically want to rent, young professionals are attracted by the freedom as their careers invariably change direction, and even retirees looking for opportunities to move closer to family or travel are opting to rent. Worryingly though, according to The Royal Institution of Chartered Surveyors, rents are likely to rise by 25% over the next five years as landlords scale back their portfolios, leaving tenants fighting over diminished supply.

I have worked with thousands of landlords over the years, some of which it’s fair to say had failed in some part in their duty of care. But these are the minority and you can see examples of where they have gone wrong in Channel Five’s ‘Nightmare Tenants, Slum Landlords’, which Landlord Action features heavily in, trying to educate landlords and tenants on the pitfalls of buy-to-let.

However, I have also worked with far more excellent landlords who keep well maintained, beautifully decorated rental homes. They are fully compliant with regulation, have the necessary deposit protection and insurance in place, and attend to their tenant’s every request efficiently and professionally.

In addition, I bet there are also lots of landlords and tenants out there who will identify with a situation where patience and empathy has gone a long way. You see, landlords are a diverse group of people clubbed together under one title “landlord”. They can be teachers, doctors, nurses, retirees, the list goes on, but they are also all people. When a tenant has a genuine reason for why they are late with their rent, for example, through sickness or a problem at work, there are many landlords who will be willing to listen to their tenants and support them by granting a little extra time or setting up a payment plan to get them back on track. Remember, most landlords want tenants to stay in properties as long as possible, even by reducing rent, to avoid voids and re-letting costs.

Despite recent efforts to increase institutional investment and large-scale PRS developments, in the belief that the consumer (tenant) will be offered a better class of accommodation and local amenities, the sector remains dominated by small-scale landlords. However, the build-to-rent model, with market rents, may not be suitable for a large proportion of the PRS market, particularly low-income households.

If landlords continue to be vilified and punished, more and more will be forced out of the market. But without any guarantee that it will make a difference to the people who want to buy property, and certainly not in the same way as say reducing stamp duty would, aren’t we just shifting the supply problem from buyers to renters?

Yes, there are bad landlords but also good landlords who offer high spec accommodation at affordable prices with great management service. Let us not forget….there are also good tenants and bad tenants, just as there are good businesses and bad businesses – but those that perform well should be praised.

Maybe it’s time we stopped the “landlord bashing” and gave some recognition to the ones who are doing a great job in supporting nearly 20% of our housing market!

In fact, I think we should have a National Landlord Day to celebrate these unsung heroes and highlight the vastly positive experience of most tenants. A well needed shot in the arm for an increasingly beleaguered sector but I’m not sure how that would go down with the National press, Shelter or Generation Rent?

jQuery(document).bind(‘gform_post_render’, function(event, formId, currentPage){if(formId == 110) {} } );jQuery(document).bind(‘gform_post_conditional_logic’, function(event, formId, fields, isInit){} ); jQuery(document).ready(function(){jQuery(document).trigger(‘gform_post_render’, [110, 1]) } );

The post Punishing private landlords – help or hindrance? appeared first on Property118.

View Full Article: Punishing private landlords – help or hindrance?

No WI-FI? No Rent

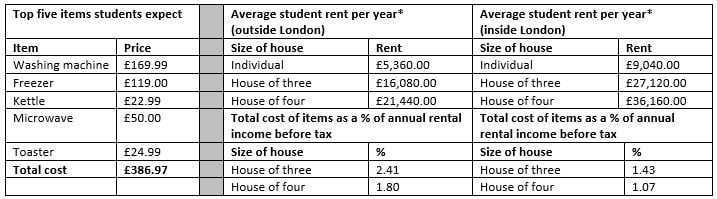

Student landlords who fail to properly invest in technology may well be losing out on significant income, according to a new study commissioned by Currys PC World Business.

The findings reveal that technology can make all the difference when it comes to renting, with nearly half of students (44 per cent) willing to pay more for fibre optic or high-speed internet.

Wi-Fi is fast becoming a hygiene factor for students, along with kitchen appliances such as freezers or washing machines, with over half (55 per cent) expecting to see it in the property. Moreover, more than a third (35 per cent) would not rent a property that didn’t have an internet connection.

This demand for improved technology also extended to the kitchen, with the research finding that most students now expect to see everything from kettles, toasters and microwaves included in their rent. In fact, if they were missing, they could seriously harm your chances of renting a property, with over one in three (36 per cent) of students saying a lack of microwave would be a big turn-off. At the same time, 16 per cent felt a lack of kettle could scupper any deal while 14 per cent saw a lack of toaster as a bad sign.

Overall, 60 per cent of students felt that electricals and kitchen appliances played a big part in their renting decision.

High Maintenance

It seems that with the rise in tuition fees, and increasing rental prices, student expectations have risen: nearly a third of students (29 per cent) labelled themselves as high maintenance, expecting an elevated level of service from their property.

Indeed, 85 per cent of students admitted they were more likely to rent a property if all appliances were new, emphasising the importance of investing in the right technology. This was closely linked to the fact that 59 per cent felt they would be unable to afford the costs in furnishing their own property.

The Cost of Happy Tenants

The table below compares the average annual rental income a landlord can expect from a three or four-bedroom student property against the cost of buying the top five items students require new at Currys PC World:

Similarly, keeping things continually up to date is also important, with 86% of students claiming they would change property at the end of their tenancy due to electricals being broken and left unfixed.

Simon Moyle, Head of Business Solutions at Currys PC World Business, comments:

“With well over half a million students in the UK this is a market that represents a huge opportunity for landlords, and one where the right investment can make all the difference. What’s more, research from mortgage lender Paragon found that student properties typically enjoy a yield premium of around 27 per cent over the market average – demonstrating that it can be a hugely profitable area of investment.

“Crucially, landlords must move with the times; while students may have previously headed off to university with nothing more than clothes and books, technology has become a central part of the student experience, and something that landlords must deliver on if they want to make top dollar in the market.”

Currys PC World Business is an official supplier of the Landlord National Purchasing Group, a landlord buying group that is committed to offering its membership the best products at the most competitive prices. Nick Watchorn, Founder, Landlord National Purchasing Group, said:

“We’ve seen a significant shift in demands over the last few years from student landlords. Where it was previously just beds and bookcases, they’re now buying large volumes of high quality white goods, electricals, and furniture, as students increasingly expect more for their money. Landlords must adapt to these changing needs in order to avoid being left behind in this increasingly competitive sector.”

The research was commissioned by Currys PC World Business as it launches its latest ‘Landlord Solutions’ guide containing hints, tips and advice to private landlords about how to better look after tenants, and what to bear in mind when renting a property. The guide is available here.

The post No WI-FI? No Rent appeared first on Property118.

View Full Article: No WI-FI? No Rent

I am worried, seriously worried … and here’s why

Around 20% of the landlords who consult me regarding tax ask about the “Hybrid strategy” or the “LLP to Incorporation Strategy”.

The reason I am so worried is that these structures are scheming to abuse the tax system, and it is only a matter of time before HMRC react to that or HM Treasury influences new legislation to ensure they fall under GAAR legislation (General Anti Abuse rules) or insist they should have been registered under DOTAS (Disclosure of Tax Avoidance Schemes). You may well have read about Film Partnerships and how some of those schemes abused the tax system. HMRC have powers to serve APN’s (Advance Payment Notices) on those who participate in such schemes, which call for the tax that would ordinarily have been paid to be paid immediately. It is then up to the individuals to prove the tax wasn’t due and to reclaim it. For many landlords, the consequences of that, given the amounts of money involved, could prove fatal to their businesses.

The Hybrid and the LLP to incorporation strategy “schemes” are being touted extensively by one particular company which visits all the landlord and property shows, and clearly has a very large marketing budget. The bottom line is that the promoters of these schemes are charging eye watering amounts of money to dress businesses up with a view to abusing the tax rules. In the examples I have written warning articles about, I have explained why the “schemes” are extremely high risk in my opinion. The problem is that the message isn’t being spread as and wide as it needs to be.

Please click on the articles below, read them and then share them with friends who might be considering these strategies. When you read my articles you will hopefully be as worried for your friends as I am about these schemes.

So how should tax planning work?

Let’s say for example that incorporation is your goal. The first consideration must be whether the transfer of properties from personal ownership to the company will trigger a CGT bill. If HMRC consider that you are running a business you will have the right to roll your capital gains into the shares in your new company. You don’t need a “scheme” to do that.

HMRC’s definition of a business is that: –

- Activities are a serious undertaking earnestly pursued

- Activity is a function pursued with reasonable or recognisable continuity

- Activity has a certain measure of substance in terms of turnover

- Activity is conducted in a regular manner and on sound and recognised business principles

- Activities are of a kind which, subject to differences in detail, are commonly made by those who seek to profit from them

Perceptions can prove to be important. Accordingly, we recommend that you have the following in place:-

- A business website

- Business stationery including letterhead and business cards

- A business email account

- A business telephone number

This is because you will need to convince HMRC that you are indeed running a business, as opposed to curating an investment portfolio which does not qualify for the relief.

The next consideration is Stamp duty. Again, you don’t need “schemes”. The law is very clear, if two or more people are running a business then a partnership exists under the Partnership Act 1890. You do not need to be an LLP or even to have registered a partnership with HMRC for the treatment of partnership rules to be applied to SDLT. Again, this is clear in HMRC’s internal manuals which we are always happy to share with our clients and their professional advisers.

The third consideration is the cost of refinancing. To avoid these costs, and if you prefer to retain the favourable mortgage terms you currently enjoy, we recommend the Beneficial Interest Company “BICT” strategy. This also has non-statutory clearance from HMRC, despite that fact that it’s purpose is to avoid refinancing costs as opposed to avoiding tax. The reason for this is that some client’s professional advisers, and even two National Newspapers, considered that some of the quirks within the structure were ambiguous in regards to tax legislation. We didn’t want to rely on a Barristers Opinion so we went direct to HMRC.

For absolute peace of mind, to ensure you qualify for the relief prior to incorporating, Property118 Limited recommends you to seek non-statutory clearance from HMRC on whether they consider you to be a business. This is the only area of ambiguity.

Property118 Limited has significant experience in helping landlords to draft their non-statutory clearance applications, our charges for which are £1,500 + VAT. We are so confident in our legal arguments in this regard that we provide a guarantee to refund fees if HMRC clearance is declined. We prepare all the paperwork and all you have to do is to sign and submit it. We have a 100% record of success.

We work very closely with Cotswold Barristers to deal with implementation, but we do not rely on Barristers’ opinions. It is the opinion of HMRC in regards to the legislation being relied upon which matters. Our guidance does not seek to abuse the tax system in any way.

Tax isn’t the only reason for incorporating either. There are many other considerations, some of which are positive and some of which are less so. One should never allow the tax tail to wag the dog!

Show Tax Consultation Booking Form

The post I am worried, seriously worried … and here’s why appeared first on Property118.

View Full Article: I am worried, seriously worried … and here’s why

Agent continues to trade and gets extra 4 year ban by TPO

Truro based letting agent Prmier Property Management was banned from operating by The Property Ombudsman (TPO) for 2 year last November.

However, as the subject of a BBC investigation they were found to still be trading this February and the TPO received a further seven client complaints resulting in additional awards against the agents totaling £20,566, none of which has been paid.

The BBC alleges that over £35,000 is owed to landlords and tenants in rent and deposits with one landlord being owed £4,200.

Katrine Sporle, Property ombudsman said: “This agent’s behaviour fell well below the standards expected and their systematic failure to pass on rental payments and deposits received has affected the lives of several landlords.

“Cases like these are fortunately extremely rare, but do highlight the importance of consumers keeping their own written records so I can review emails, bank statements and correspondence as part of my investigation to determine if the agent has acted fairly.”

Although the agency has been banned from operating apparently there is no system in place to stop the owner from moving on and continuing to work in the industry.

This Autumn a Blacklist of banned lettings industry individuals is being set up, but the general public. However, the list will only be accessible by Local Councils and the Department for Communities and Local Government and not open to private firms or the general public.

Jane Erskine, Deputy Ombudsman said: “It is Premier Property Management who is a member and hence the agent who has been expelled from membership of TPO.

“An agreement between the three Government approved redress schemes means this agent will not be able to register for any form of redress until all awards are paid. Expelling an agent also affects a decision to allow any other agent with the same director or partner to join TPO in the future. Redress registration is required for an agent to trade legally.

“As a consumer redress scheme, we cannot regulate the industry. When an agent is expelled by TPO, we notify Trading Standards as they are the regulatory body who are able to take enforcement action to stop an agent trading illegally. Trading Standards were notified of the expulsion in November 2016.

“As Premier Property Management failed to abide by the Ombudsman’s decision in other cases that had been referred to TPO prior to November 2016, these further case were referred to the Disciplinary and Standards Committee, who increased the expulsion period. TPO understands that PPM is no longer trading and the website is no longer active.”

The post Agent continues to trade and gets extra 4 year ban by TPO appeared first on Property118.

View Full Article: Agent continues to trade and gets extra 4 year ban by TPO

Checking tenants Right to Rent

This is the 8th post in my 2017 Legal Update series.

Ever since 1 February 2016 (or 1 December 2014 for landlords around Birmingham) landlords and agents in England have had to check whether the people who will be occupying their properties have a ‘right to rent’ in the UK.

It has caused a lot of worry and work all round and there is a question mark over its effectiveness – as it appears that few people have actually been deported as a result.

Indeed, moves are afoot to challenge the expansion of the regulations to Wales and Scotland.

However, in England we are stuck with them. With Brexit, it is unlikely that they are going to be rescinded any time soon. So, what do they involve?

Focus on damage limitation

The main thing for landlords and agents to appreciate is that your job is not to catch illegal immigrants for the Home Office (that’s their job) but to make sure that you have complied with the regulations so you can’t be fined or prosecuted.

So, you need to:

- Read and follow the government’s online guidance

- Check EVERYONE who is going to live in the property – whether or not they are actually going to be a tenant (underage children do not need checking but make sure you get proof of age, particularly if they are a teenager).

- Make sure you keep a detailed record of your check and the paperwork provided – so you can produce it if challenged.

Here are some tips for you:

- Make sure you check the online guidance regularly – it changes every now and again and you need to be using the most recent version. You will be deemed to have had notice of this so if you don’t do what it says you could be in breach of the rules.

- Have a form which you use to record the check (there is one on Landlord Law for members and you will find a different free form here).

- Don’t just save the paperwork, but details of your interview too. For example, if there are any suspicious circumstances e.g. a single man renting a five-bedroomed house, you need to be able to show that you have asked them about it. So, you will be able to prove (in our example), if asked, that you have checked to make sure that the single man is not going to use the spare bedrooms to house illegal immigrants!

- Make sure you keep the form and copy paperwork for as long as necessary.

- Make NO exceptions to the checks. Even if you are renting to your Mother, it is a good idea to have a record on file of her passport. If you are seen as regularly making exceptions to the checks for example for people who are white and appear to be English, this is discrimination which is a criminal offence.

The new Immigration Act 2016

As you are probably aware there has been a new Immigration Act which came into force in December 2016. There are two aspects of this you need to know about:

- The new grounds and procedures for evicting those without a right to rent in your properties and

- The new criminal penalties for landlords who breach the rules

You probably don’t need to worry too much about the criminal penalties. These are really aimed at criminal landlords such as those who deal with people trafficking, rather than ordinary landlords who happen to have made a mistake. Still the criminal penalties are there, so best not to make any mistakes!

The new eviction procedures are:

- A new ground for possession (ground 7A) and

- A new procedure to evict occupiers via the High Court Sheriffs without having to get a court order first if you are served a notice by the Home Office.

It is unlikely that you will actually have to use these procedures if you do your checks properly but it’s a good idea to know that they exist.

Further information:

Our 2017 Conference Course includes a ½ hour talk on right to rent from Immigration expert Sue Lukes where she talks though the regulations and how they work and explains all the new rules in some detail.

This is a really useful talk to bring yourself and your staff (if you have any) up to date. It will also be useful for new staff as part of your induction process.

You will find more information about the Conference Course here. There is discount voucher for Property118 readers which is pp118cc30 – apply this on the checkout page and it will reduce the payment by 30%. Note however that the coupon will expire after 16th September.

There is also a right to rent section on my Landlord Law membership site, with forms and FAQ plus members can also ask me ‘quick questions’ in the members forum area.

You can find out more about Landlord Law here

Next time I will be writing about tenancy agreements.

Tessa Shepperson is a specialist landlord & tenant lawyer and runs the popular Landlord Law online information service.

To see all the articles in my series please Click Here

The post Checking tenants Right to Rent appeared first on Property118.

View Full Article: Checking tenants Right to Rent

Civil Penalties for Landlords in Stafford

Quick Justice:

Stafford Borough Council is all set to give the go-ahead to using civil penalties* as a way to punish rogue landlords more quickly than taking them to court.

The Residential Landlords’ Association (RLA) reports that at a recent council meeting plans were laid to introduce new civil penalties for rogue landlords to speed up the process of bringing them to justice and cleaning up rogue landlord operations in the borough.

Previously justice was often slow and labour intensive as using the court process. However, new laws introduced recently will allow local authorities to hand out instant justice; fines ranging from £1,000 to £30,000, with a minimum of time consuming bureaucracy needed. These fines will be issued for offences ranging from excessive damp and mould to fire and electrical hazards, or indeed anything which could affect the health and safety of tenants.

Stafford Borough Council’s community portfolio holder, Councillor Jeremy Pert, told the RLA:

“The overwhelming majority of landlords in the Borough provide a high standard of accommodation and have an excellent relationship with the Council and their tenants. However, there are a very small number that fail to engage with the Council and knowingly rent unsafe and substandard accommodation.

“In light of the generally high standard of both accommodation and landlords in the Borough it is anticipated this power will be rarely used, however, it will ensure officers have all the necessary legislative tools at their disposal to protect the health, safety and welfare of tenants in the private rented sector.”

The decision comes following a case last year which involved a Stafford landlord being found guilty of a range of charges, including the failure to fit a suitable fire detection system in his rental property.

The home was also in poor standard, and the landlord had not obtained the correct license from the borough council. The landlord in question was fined £14,000. However, under the proposal to allow the council to distribute civil penalties, the fine could be more than doubled.

Councillor Pert continued:

“The introduction of financial penalty charge notices as an additional enforcement measure allows authorised officers to choose the best course of action in regards to the behaviour and actions of non-compliant landlords. The Government’s position is clear in requiring Local Authorities to be robust in their enforcement approach.”

*Civil penalties for landlords and agents were introduced in the Housing and Planning Act 2016. In the act the government introduced a range of new measures available for local authorities in relation to their dealings with rogue landlords: civil penalties, rent repayments orders, banning orders and the introduction of a database for rogue landlords and letting agents. From April 6th 2017, some of these powers came into force as the civil penalties are introduced and rent repayment orders were significantly strengthened. The banning orders and database come into force from October 1st 2017.

Civil penalties are an alternative to prosecution for a variety of offences under the Housing Act 2004. Previously local authorities would have to bring a criminal prosecution against the landlord or letting agent, a time-consuming process. For any of the listed offences, local authorities will now be able to fine the landlord as an alternative to bringing a prosecution against them. The legislation includes an appeals process.

©1999 – Present | Parkmatic Publications Ltd. All rights reserved | LandlordZONE® – Civil Penalties for Landlords in Stafford | LandlordZONE.

View Full Article: Civil Penalties for Landlords in Stafford

Airbnb management company active in 8 cities

Press release from Pass the Keys:

Pass the Keys, a fast-growing property tech start-up, completed their second round of funding led by London-based VC, Talis Capital. The funding will support further platform improvements and expand the service offering to more cities in the UK and internationally. The company closed its seed round back in October 2016, also led by Talis Capital.

Founders, Alexander Lyakhotskiy and Zoe Vu, developed Pass the Keys in London Business School’s incubator program and focused on leveraging technology to provide a unique service to Airbnb hosts and help them with hassle-free rentals. Pass the Keys currently operates in eight cities across the UK – London, Edinburgh, Manchester, Brighton, Bath, Bristol, Cambridge, and Oxford – expanding at a pace of one new city a month and is the fastest growing Airbnb Management Company in the world and now covers more UK cities than any other provider.

CEO Alexander Lyakhotskiy commented: “Property is one of the biggest assets for any family and, through our technology solution, we give property owners the ability to maximise their investments hassle-free. Our key differentiators are our revenue management system, but also our focus on security via rigorous guest vetting and photo checks.”

Vasile Foca, co-founder and Managing Partner of Talis Capital, said: “It has been great to see Pass the Keys capitalise on what continues to be a growing sector in property tech. The company has already become the largest Airbnb property manager in the UK as it offers its services in 8 cities. The focus on strategy and automation of various processes, particularly the onboarding of clients, cleaners, and vendors, have allowed the Pass the Keys to become a leading multi-city, multi-platform property manager in the UK. We very much look forward to working with them in their growth to attain this traction internationally.”

Alexander Lyakhotskiy added: “ We are very confident about the future of the sharing economy in the UK and worldwide, and we are grateful for the continued support from Talis Capital. This new funding will allow us to improve our service further, as well as continue our ambitious growth plans. By the end of 2017, we aim to offer our service in all major cities in the UK and start our global expansion from 2018.”

Editors Note:

We have called Pass the Keys to ask how the process works to check if it is the owner of the property who is going to list the accomodation on Airbnb. This is obviously of concern to Landlords due to the risks associated with subletting.

Pass the Keys have confirmed that when an initial enquiry is made that the potential customer is called directly and asked if they own the property along with other questions such as when was the property last refurbed, boiler make, maintenance etc. that would be more difficult potentially for a tenant to answer.

There is also a clause in the Pass the Keys contract confirming the customer must have the right to rent the property. Although land registry searches or documented proofs are not required due to the practicalities of the numbers.

The post Airbnb management company active in 8 cities appeared first on Property118.

View Full Article: Airbnb management company active in 8 cities

Belvoir steps up acquisition programme

Belvoir has reported on the completion of 12 franchisee-led acquisitions in 2017, and confirms that further acquisitions are in the pipeline.

Dorian Gonsalves, CEO of Belvoir says: “Business development via our Assisted Acquisitions Programme has been a major growth strategy for the Belvoir Group throughout 2017.

“Earlier this year we embarked on a series of Acquisition Roadshows to provide our franchisees – including those from our recently acquired networks – with the information they needed to help them make informed decisions. Of the twelve acquisitions, six were secured by Belvoir franchisees, five by Northwood franchisees, and a further one by a Newton Fallowell franchisee.

“Our Acquisition Team, led by Martin Bunney, Belvoir’s Head of Franchise Recruitment, Property and Acquisitions, provides fantastic support to franchisees throughout the entire process. This support includes sourcing potential acquisitions and matching them to interested franchisees, checking compliance, assisting with terms, finding the funding, negotiating the deal, and ultimately helping to deliver the outcomes that allow our franchisees to take full advantage of their market position. Our franchise support team continues to assist franchisees after the acquisition completes, as and when this support is required.

“These acquisitions have added a further 1,310 properties to the Group’s collective portfolio, and Belvoir now manages a grand total of 57,637 managed properties.

“I can confirm that further acquisition deals and opportunities are in the pipeline and I would encourage any independent agents who are considering their exit strategy to contact Belvoir ‘s Acquisition Team for a confidential discussion about what mutually beneficial opportunities may be available.”

Clayton and Nina Foston of Belvoir Nuneaton and Hinckley recently completed on the acquisition of Easy Lets and Sales in Hinckley, Leicestershire. Speaking of the acquisition, Clayton said:

“We would like to express our sincere gratitude to Dorian, Martin and all at Belvoir for their support with our acquisition. This exciting venture will add a further 300 fully managed properties to our existing portfolio of in excess of 450, making us the most significant agent in the area.

“We are now on the look out for a new site that will be “fit for the next decade, and we are delighted that Graham Phipps, who was the former owner of Easy Lets and Sales has joined our team as sales manager, bringing with him significant experience in this area.

“We were helped with the process every step of the way, and Belvoir’s contacts and suggestions were essential to the success of the acquisition. We urge others within the network to be brave in these challenging times and never to believe that something is unattainable so long as you use the resources that Belvoir makes available to us all.

To find your nearest Belvoir office please visit www.belvoir.co.uk. To contact Martin Bunney, telephone 01476 570000 or email franchising@belvoir.co.uk

The post Belvoir steps up acquisition programme appeared first on Property118.

View Full Article: Belvoir steps up acquisition programme

Property Partnership Between Spouses

I have read with interest the articles on forming a property partnership as a way of allocating profit to a partner on a lower tax band. I have also purchased and read the “Guide to Forming a Property Partnership” which was very helpful and I think this would suit us. My husband and I jointly own and rent out 2 properties in Scotland. He works and pays tax at the higher rate whereas I am not employed. When we come to fill in our tax forms we have to pay a large amount of tax on my husbands share of the income.

Since we live in Scotland it does not seem possible to use a Deed of Trust to move most of the ownership into my name. It seems that here we have to do normal conveyancing and that involves mortgages so is not really an option for us.

The partnership option does look like a way forward. I looked at the form SA400 and there are a couple of questions that I would like advice on.

1. “What is the nature of the business”. What would other users suggest I put in here to have the best likelihood of it being accepted as a business by HMRC? I was thinking of putting “Property rental including management, maintenance and tenant sourcing”. Does anyone have any better suggestions?

2. What date do I put in the “When did the business commence” box? According to the form it looks like the earliest date I can enter is 6th April 2016, as it says I have to register by 5th October in the business’s second tax year or there could be a penalty. We have been doing the work for 4 years. Would this be the best date to put in?

Also, while reading about this on various sites I read somewhere that partnerships between married couples still have to allocate the profit either 50-50 or in the actual ownership share whereas non-married partnerships can allocate profits as they wish. Is this correct? If it is then the partnership would not help us.

I am hoping that there are others out there who have already taken this step and can provide some insight for me.

Thanks

Angela

The post Property Partnership Between Spouses appeared first on Property118.

View Full Article: Property Partnership Between Spouses

Consumer Law and why you should be worried about it

This is the 7th post in my 2017 Legal Update series.

The Consumer Legislation – does it apply to YOU?

When I mention ‘Consumer law’ to most landlords they just look at me blankly. “What’s consumer law got to do with me?” one landlord asked at a training workshop earlier this year. Maybe she speaks for you too?

Landlords tend to think of themselves as investors. However, what you have to realise is that to the authorities (Government and Local Councils), and also your tenants – you are running a service business for consumers.

In fact, the service you are providing is for one of the most basic human needs – shelter. Of course, consumer protection laws are going to apply to you!

Letting agents too – most of your customers will not be ‘professional’ landlords. The consumer legislation will apply to you as well.

Consumer rights and fairness

What sort of things are we talking about?

The main act is the Consumer Rights Act 2015 along with various regulations that provide protection to consumers. Such as the Consumer Protection from Unfair Trading Regulations 2008.

Central to these is the concept of ‘fairness’. This is that businesses should be straight with consumers and not mislead them, that contracts should be even handed and not stacked in the business’s favour, and that businesses should actually do what they contracted to do.

So, if you are a landlord, this means that

- Your tenancy agreements should be clear and fair,

- Your advertising must not be misleading (e.g. if a property is described as ‘quiet’ it should not be on the school run), and

- That if you promise, before the tenancy agreement is signed, to do any repair or improvement work to the property – you should actually do it.

If you are an agent, this means that

- You must do the work you contracted to do (such as regular inspections of the property)

- You should ensure that the deposit is properly protected and the prescribed information served and also

- You are not entitled to receive commission in perpetuity without actually doing any work, simply because the tenant has stayed on in the property (sorry).

If these standards are not kept then there are consequences – which could prove expensive.

Tenants, for example, can ‘unwind’ their tenancy (i.e. end it) if they have been induced to enter into it by an unfair practice (such as misleading information about the property), provided they give notice within 90 days.

If they give notice within 30 days they can also reclaim all money paid.

Paperwork and procedures

It is important also that you follow all the proper procedures.

If you trade through a limited company – is your company name, number, place of registration and registered office address on all your stationery including your emails?

If you are an agent, in many cases you will reach agreement with your landlord outside your office, for example after visiting the property. If so, are you providing your landlords with details of their 14-day cancellation rights?

If not, your landlords may be entitled to cancel their contract with you at any time up until either you provide the cancellation information or after one year. AND if they do this, you will have to refund any fees paid.

These cancellation rights come under the Consumer Contracts (Information, Cancellation and Additional Charges) Regulations 2013.

A warning to landlords

For you to be able to take advantage of these rights vis a vis your letting agent – you must be trading in person. If you run your properties through a limited company, you will be treated as a business and not a consumer.

This is something you should take into account if you are considering setting up a company for your properties for tax purposes.

Further information:

In this blog series, I can only touch on things lightly.

Therefore, as part of this Legal Update initiative I am also making available our Conference Course at a special discount for Property118 readers. The Conference Course is particularly valuable as it contains all the talks from our 2017 Landlord Law Conference (plus a few from earlier Conferences). One of the 2017 talks is on consumer law.

You will find more information about the Conference Course here. The discount voucher is pp118cc30 – apply this on the checkout page and it will reduce the payment by 30%. Note however that the coupon will expire after 16th September.

There is also a section on consumer law on my Landlord Law membership site and members can ask me ‘quick questions’ in the members forum area.

You can find out more about Landlord Law here

Next time I will be looking at the right to rent rules.

Tessa Shepperson is a specialist landlord & tenant lawyer and runs the popular Landlord Law online information service.

To see all the articles in my series please Click Here

The post Consumer Law and why you should be worried about it appeared first on Property118.

View Full Article: Consumer Law and why you should be worried about it

Categories

- Landlords (19)

- Real Estate (9)

- Renewables & Green Issues (1)

- Rental Property Investment (1)

- Tenants (21)

- Uncategorized (12,524)

Archives

- March 2026 (21)

- February 2026 (55)

- January 2026 (52)

- December 2025 (62)

- August 2025 (51)

- July 2025 (51)

- June 2025 (49)

- May 2025 (50)

- April 2025 (48)

- March 2025 (54)

- February 2025 (51)

- January 2025 (52)

- December 2024 (55)

- November 2024 (64)

- October 2024 (82)

- September 2024 (69)

- August 2024 (55)

- July 2024 (64)

- June 2024 (54)

- May 2024 (73)

- April 2024 (59)

- March 2024 (49)

- February 2024 (57)

- January 2024 (58)

- December 2023 (56)

- November 2023 (59)

- October 2023 (67)

- September 2023 (136)

- August 2023 (131)

- July 2023 (129)

- June 2023 (128)

- May 2023 (140)

- April 2023 (121)

- March 2023 (168)

- February 2023 (155)

- January 2023 (152)

- December 2022 (136)

- November 2022 (158)

- October 2022 (146)

- September 2022 (148)

- August 2022 (169)

- July 2022 (124)

- June 2022 (124)

- May 2022 (130)

- April 2022 (116)

- March 2022 (155)

- February 2022 (124)

- January 2022 (120)

- December 2021 (117)

- November 2021 (139)

- October 2021 (130)

- September 2021 (138)

- August 2021 (110)

- July 2021 (110)

- June 2021 (60)

- May 2021 (127)

- April 2021 (122)

- March 2021 (156)

- February 2021 (154)

- January 2021 (133)

- December 2020 (126)

- November 2020 (159)

- October 2020 (169)

- September 2020 (181)

- August 2020 (147)

- July 2020 (172)

- June 2020 (158)

- May 2020 (177)

- April 2020 (188)

- March 2020 (234)

- February 2020 (212)

- January 2020 (164)

- December 2019 (107)

- November 2019 (131)

- October 2019 (145)

- September 2019 (123)

- August 2019 (112)

- July 2019 (93)

- June 2019 (82)

- May 2019 (94)

- April 2019 (88)

- March 2019 (78)

- February 2019 (77)

- January 2019 (71)

- December 2018 (37)

- November 2018 (85)

- October 2018 (108)

- September 2018 (110)

- August 2018 (135)

- July 2018 (140)

- June 2018 (118)

- May 2018 (113)

- April 2018 (64)

- March 2018 (96)

- February 2018 (82)

- January 2018 (92)

- December 2017 (62)

- November 2017 (100)

- October 2017 (105)

- September 2017 (97)

- August 2017 (101)

- July 2017 (104)

- June 2017 (155)

- May 2017 (135)

- April 2017 (113)

- March 2017 (138)

- February 2017 (150)

- January 2017 (127)

- December 2016 (90)

- November 2016 (135)

- October 2016 (149)

- September 2016 (135)

- August 2016 (48)

- July 2016 (52)

- June 2016 (54)

- May 2016 (52)

- April 2016 (24)

- October 2014 (8)

- April 2012 (2)

- December 2011 (2)

- November 2011 (10)

- October 2011 (9)

- September 2011 (9)

- August 2011 (3)

Calendar

Recent Posts

- Should I abandon the strategy that built my wealth?

- Gen Z renters lack knowledge of credit scores and rent rules

- Google searches for Making Tax Digital hit record high

- The Property118 Housing Research Panel

- Are tenants beginning to see the problem of landlords leaving?

admin

admin