Borrowing request hits brick wall?

After some advice, as have been a bit naive and hit a brick wall. I am looking to borrow more money against a property which has some equity in it, but is not due for remortgage yet.

My thinking is that I’d like to have some money available should an opportunity come up to invest and if I can’t find anything that I have additional money in case I need it as a liquidity buffer. I would invest the money in peer-to-peer to help cover the interest.

However, having applied I have been asked for the mortgage offer on a property I haven’t found yet. I’d appreciate people’s thoughts on whether I should reapply for a different use and if so what’s acceptable i.e could I say I would put the money in peer-to-peer? Or that I would spend it on property repairs?

I don’t see the point in continuing on the basis of a property investment until I find a place to buy as I’d incur survey fees etc.

However, I’d really like to hold the money rather than the bank having my equity particularly as interest rates look like they will rise.

Many thanks

Richard

The post Borrowing request hits brick wall? appeared first on Property118.

View Full Article: Borrowing request hits brick wall?

ARLA confirms landlords ‘rough ride’ is being passed on to tenants

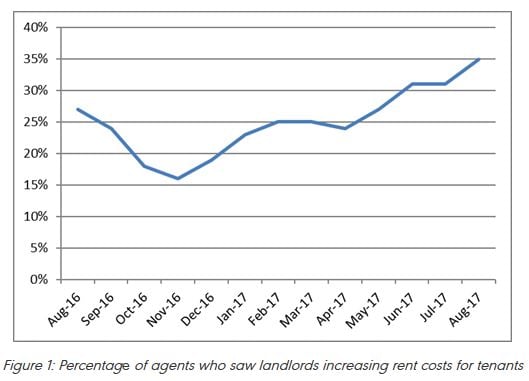

The Latest figures from the ARLA Propertymark report shows that in August agents reported 35% of landlords increasing rental costs to tenants. This figure has risen from 27% last year and is the highest figure since July 2015 at 37%.

This compares to only 2% of tenants who were able to achieve a rent reduction.

Demand from new tenants looking to rent per ARLA member letting agents increased to 72 per branch and the average number of properties landlords were looking to sell per branch was 3 out of an average 189 properties per branch.

ARLA Propertymark chief executive, David Cox, said: “This month’s findings paint another bleak picture for tenants. In November last year, only 16% of agents saw landlords increasing rent costs, but that figure now stands at 35%, which is likely to continue rising.

“Landlords have had a rough ride at the hands of policy changes at government level, and it’s becoming clear that these additional costs are now being passed onto tenants.”

Please see the graph below and for the full ARLA report please Click Here

The post ARLA confirms landlords ‘rough ride’ is being passed on to tenants appeared first on Property118.

View Full Article: ARLA confirms landlords ‘rough ride’ is being passed on to tenants

Tenant running out on utility bills

I rented my property and once the tenant moved out she left owing nearly £700 in utility bills.

She contacted the gas company and said she was just renting a room from me and that I was responsible for the bills.

This of course wasn’t true, this has gone on for over 2 years, she has disappeared and I’m pretty sure she will do the same again as I have found out she had done the same at a property prior to renting mine.

What can I do?

Many thanks

Stuart

The post Tenant running out on utility bills appeared first on Property118.

View Full Article: Tenant running out on utility bills

Mezzanine Finance – a solution for building homes outside the big corporates

The UK housing shortage will not be successfully addressed if we rely entirely on the major house builders. This is the view that was expressed by the government housing White Paper at the beginning of the year, which recognised both the importance of creating a diverse construction sector and the significant contribution that can be made by the development of smaller sites.

Securing the appropriate funding will be key in determining whether small developers are able to step up to the challenge and take advantage of this opportunity and, for many, achieving the right leverage at the right price will be the main consideration.

Conventional senior debt development finance was traditionally limited to around 50% gross development value (GDV), but it is now possible to secure finance up to 70% GDV with some specialist providers. This is known as stretch-senior debt and, while it offers greater leverage, it is also more expensive than senior debt.

An alternative to stretch senior is to split the financing into two layers of debt instead of one. The first layer, the senior, can be structured conservatively at low cost, often by a large bank. On top of this senior layer sits a strip of mezzanine debt from a specialist provider in a second charge, subordinated position.

In isolation mezzanine finance, or “mezz”, looks expensive, but when it is blended with a bigger chunk of cheap senior debt, the overall cost can be lower than a stretch senior deal can achieve.

There is more work in assembling and managing a structured solution that includes mezz, but for some developers it can provide a cheaper way of securing increased leverage on their schemes.

If you are a developer and would like to discuss how you could use mezzanine finance on your next development, please complete the contact form below and we will be happy to help.

jQuery(document).bind(‘gform_post_render’, function(event, formId, currentPage){if(formId == 214) {} } );jQuery(document).bind(‘gform_post_conditional_logic’, function(event, formId, fields, isInit){} ); jQuery(document).ready(function(){jQuery(document).trigger(‘gform_post_render’, [214, 1]) } );

The post Mezzanine Finance – a solution for building homes outside the big corporates appeared first on Property118.

View Full Article: Mezzanine Finance – a solution for building homes outside the big corporates

Student Rents remain static says new report…

Student Landlords:

A new report highlights static accommodation costs across England in the wake of rising student debt.

An annual report (1) into student accommodation, compiled by Glide Utilities, the student utilities and service provider, has found that private student rent has remained at an average of £100 – £119 a week, for the second year running.

The news comes as a respite for students, who face increasing debts, with the Institute for Fiscal Studies (IFS) last month reporting that students in England are likely to graduate with debts just shy of £60,000. (2) The fourth annual ‘What Students Seek’ report found that 20% of students don’t envisage paying off their loans, a number that is dramatically out of sync with the IFS, which forecasted that three quarters of students will never be able to pay off their loans.

Accommodation represents the second biggest spend for students during their studies following fees. The What Students Seek report found that 72% of students pay between £80 and £139 per week. University locality creates some variance with 15% of London students paying over £200 a week, and 69% of students in the North East paying less than £90 a week.

Almost half, 45%, of students surveyed said their accommodation offers good value for money, but 36% disagree, suggesting that while rents remain static, landlords need to understand students better to attract and retain the best tenants; a growing concern given the continued increase of modern student developments on the market. (3)

The annual What Students Seek report uncovers what students look for when it comes to their accommodation to reveal common themes that could help landlords improve the market appeal of their HMO property.

Key insights from the 2017 report:

Less is more: On average students live with four other people, with 39% sharing with five people or more. However, when asked how many people they’d ideally like to live with, almost half, 48%, indicated they’d like to share with just two or fewer people in their next property.

Switch off the TV: It appears that a television is not going to sway students into renting a property. The majority, 60%, rated having a TV as the least important factor when choosing accommodation. After cost, a fast broadband connection is by far the most important factor for students, followed by good storage space, bills inclusive and double beds.

Management: The majority of students are positive when it comes to the way their property is managed; 57% shared this view. However, almost a quarter, 23%, felt negatively citing the following top issues to be causing problems:

Lack of response on maintenance issues, (37%)

Poor upkeep of the property, (30%)

Lack of communication, (28%)

Bills included: Three quarters of students said that having bills included in their rent was either essential or quite important when considering a property, making this an easy fix for landlords and letting agents in attracting tenants.

Incentives: One in 20 students said they had been given either a cash or non-cash incentive for taking their current property. Although very low, 2% said they had been taken out for a drink by their landlord

The report also revealed the best university cities for landlords to invest in, based on overall tenant satisfaction ratings and annual yield. (4) Although there are great investment opportunities across the UK, university cities in the North East consistently rate highly for both annual yield and tenant satisfaction, with properties in Middlesbrough providing a 16.1% annual yield4 and 82% satisfaction rating. Durham and Sunderland followed close behind while on the other end of the scale, London rated lowest with just a 2.7% annual yield and 76% satisfaction rating.

Outside of accommodation needs, the report also pointed to a decline of the infamous student social life. When asked how respondents funded their social life, almost one in five, (17%) admitted that they didn’t have one. Despite this over a third still rated the proximity to bars and clubs as an important factor when choosing accommodation.

James Villarreal, CEO at Glide Utilities said of the 2017 What Students Seek Report; “It’s good news for students that private rental costs remain static, especially since the price of living in Halls of Residence continue to rise. However, it’s very likely that costs will rise moving forward as the ban of tenant fees will inevitably get passed through to the price of the rent., therefore landlords and agents can offer students greater value for money by offering bills included and ensuring that properties are well maintained and efficiently managed”

What Students Seek was commissioned in April and May 2017 by Glide Utilities. 722 students responded to the report via www.accommodationforstudents.com, the UK’s leading student accommodation website. The full report can be downloaded here.

- Results taken from a survey of 722 students in April and May 2017 as well as year-on-year data obtained from previous surveys and focus groups conducted by AFS.

- From a report by the Institute of Fiscal Studies, July 2017

- In May 2017 the property advisory group, JLL, predicted that 2017 would see a higher amount of investment in the student housing market.

- Average annual yield research taken from the Rightmove House price data, May 2017 and the Student accommodation rent report 2016 (Accommodation for Students). Average weekly rent multiplied by 3 tenants, multiplied by 52. The average annual income divided by average property price, multiplied by 100. Full report available upon request.

©1999 – Present | Parkmatic Publications Ltd. All rights reserved | LandlordZONE® – Student Rents remain static says new report… | LandlordZONE.

View Full Article: Student Rents remain static says new report…

Categories

- Landlords (19)

- Real Estate (9)

- Renewables & Green Issues (1)

- Rental Property Investment (1)

- Tenants (21)

- Uncategorized (12,522)

Archives

- March 2026 (19)

- February 2026 (55)

- January 2026 (52)

- December 2025 (62)

- August 2025 (51)

- July 2025 (51)

- June 2025 (49)

- May 2025 (50)

- April 2025 (48)

- March 2025 (54)

- February 2025 (51)

- January 2025 (52)

- December 2024 (55)

- November 2024 (64)

- October 2024 (82)

- September 2024 (69)

- August 2024 (55)

- July 2024 (64)

- June 2024 (54)

- May 2024 (73)

- April 2024 (59)

- March 2024 (49)

- February 2024 (57)

- January 2024 (58)

- December 2023 (56)

- November 2023 (59)

- October 2023 (67)

- September 2023 (136)

- August 2023 (131)

- July 2023 (129)

- June 2023 (128)

- May 2023 (140)

- April 2023 (121)

- March 2023 (168)

- February 2023 (155)

- January 2023 (152)

- December 2022 (136)

- November 2022 (158)

- October 2022 (146)

- September 2022 (148)

- August 2022 (169)

- July 2022 (124)

- June 2022 (124)

- May 2022 (130)

- April 2022 (116)

- March 2022 (155)

- February 2022 (124)

- January 2022 (120)

- December 2021 (117)

- November 2021 (139)

- October 2021 (130)

- September 2021 (138)

- August 2021 (110)

- July 2021 (110)

- June 2021 (60)

- May 2021 (127)

- April 2021 (122)

- March 2021 (156)

- February 2021 (154)

- January 2021 (133)

- December 2020 (126)

- November 2020 (159)

- October 2020 (169)

- September 2020 (181)

- August 2020 (147)

- July 2020 (172)

- June 2020 (158)

- May 2020 (177)

- April 2020 (188)

- March 2020 (234)

- February 2020 (212)

- January 2020 (164)

- December 2019 (107)

- November 2019 (131)

- October 2019 (145)

- September 2019 (123)

- August 2019 (112)

- July 2019 (93)

- June 2019 (82)

- May 2019 (94)

- April 2019 (88)

- March 2019 (78)

- February 2019 (77)

- January 2019 (71)

- December 2018 (37)

- November 2018 (85)

- October 2018 (108)

- September 2018 (110)

- August 2018 (135)

- July 2018 (140)

- June 2018 (118)

- May 2018 (113)

- April 2018 (64)

- March 2018 (96)

- February 2018 (82)

- January 2018 (92)

- December 2017 (62)

- November 2017 (100)

- October 2017 (105)

- September 2017 (97)

- August 2017 (101)

- July 2017 (104)

- June 2017 (155)

- May 2017 (135)

- April 2017 (113)

- March 2017 (138)

- February 2017 (150)

- January 2017 (127)

- December 2016 (90)

- November 2016 (135)

- October 2016 (149)

- September 2016 (135)

- August 2016 (48)

- July 2016 (52)

- June 2016 (54)

- May 2016 (52)

- April 2016 (24)

- October 2014 (8)

- April 2012 (2)

- December 2011 (2)

- November 2011 (10)

- October 2011 (9)

- September 2011 (9)

- August 2011 (3)

Calendar

Recent Posts

- Google searches for Making Tax Digital hit record high

- The Property118 Housing Research Panel

- Are tenants beginning to see the problem of landlords leaving?

- Councils collect just 25% of landlord fines

- Landlords told not to wait until Decent Homes Standard to fix rental homes

admin

admin