The paradox of Section24

Last week a reader pointed out that the gross yield figures that are bandied about are misleading and we should concentrate on the return on investment (ROI).

https://www.property118.com/using-net-rental-yields/

The gross yield is the annual gross rent as a percentage of the value of the property. The ROI is the after-tax profit as a percentage of the amount invested, basically the deposit where a mortgage is involved.

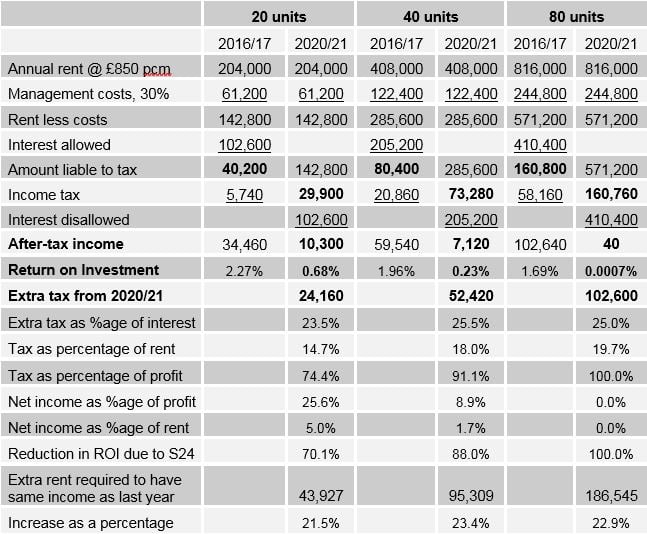

He did a calculation based on the following average figures: property price £190,000, rent £850 per month, loan 60%, interest rate of 4.5%,running costs which included full management or an employed team for the larger landlord like himself which costs 30% of the rent. He arrived at an ROI of 2.01%. The gross yield is 5.4%

The consensus was that ROI is much more useful. And somebody pointed out that we now have to take S 24 into account as it dramatically reduces after-tax profit where finance costs are incurred.

He asked readers to check his calculation. Using the above figures per unit I tried to calculate how many units he had in order to arrive at an ROI of 2.01%. Assuming that there were no joint owners, and he had no other income, the answer is nearer 40 than 20.

This calculation revealed a paradox. Normally you would expect a bigger portfolio to produce a bigger after-tax income in absolute terms, and this is what happened until last year. As the table shows, after tax income does not exactly double as the number of units doubles, but it grows from £34k to 60k to £103k

However, under S 24, after-tax income will go down in absolute terms as the size of the portfolio doubles, from £10k to £7k to almost nothing – 50p per property per year.

At 81 units the tax will exceed 100% of the real profit.

And at each size, the fictitious profit will rule out entitlement to any benefits.

The owner’s work will just be for the benefit of his tenants, his employees, his lenders and his government.

I then calculated what effect S 24 would have on ROI as from 2020/21 when it is fully phased in. At 20 units it will be reduced by seven-tenths. At 40 units it will be reduced by nine-tenths. At 80 units it will be extinguished.

The effect of Section 24 of the Finance (No.2) Act 2015 on different sizes of portfolio

The real profit figures are on the line “Amount liable to tax” in the columns headed 2016/17

The extra tax is about 45% on the interest, minus the 20% “relief”.

To avoid bankruptcy he needs to increase the rent. He should have started to do so before April when S24 began to be phased in. To maintain the same after-tax income as he had last year he will need to increase the rent by the above percentages before April 2020, from £850 to about £1,050.

It is not sufficient to increase rents by the amount of extra tax because the increase itself will be taxed at 45%.

I have assumed that his 30% management costs do not include any agents fees that would go up in line with rents. If there are, he will have to increase rents even more

The post The paradox of Section24 appeared first on Property118.

View Full Article: The paradox of Section24

Post comment

Categories

- Landlords (19)

- Real Estate (9)

- Renewables & Green Issues (1)

- Rental Property Investment (1)

- Tenants (21)

- Uncategorized (12,482)

Archives

- February 2026 (34)

- January 2026 (52)

- December 2025 (62)

- August 2025 (51)

- July 2025 (51)

- June 2025 (49)

- May 2025 (50)

- April 2025 (48)

- March 2025 (54)

- February 2025 (51)

- January 2025 (52)

- December 2024 (55)

- November 2024 (64)

- October 2024 (82)

- September 2024 (69)

- August 2024 (55)

- July 2024 (64)

- June 2024 (54)

- May 2024 (73)

- April 2024 (59)

- March 2024 (49)

- February 2024 (57)

- January 2024 (58)

- December 2023 (56)

- November 2023 (59)

- October 2023 (67)

- September 2023 (136)

- August 2023 (131)

- July 2023 (129)

- June 2023 (128)

- May 2023 (140)

- April 2023 (121)

- March 2023 (168)

- February 2023 (155)

- January 2023 (152)

- December 2022 (136)

- November 2022 (158)

- October 2022 (146)

- September 2022 (148)

- August 2022 (169)

- July 2022 (124)

- June 2022 (124)

- May 2022 (130)

- April 2022 (116)

- March 2022 (155)

- February 2022 (124)

- January 2022 (120)

- December 2021 (117)

- November 2021 (139)

- October 2021 (130)

- September 2021 (138)

- August 2021 (110)

- July 2021 (110)

- June 2021 (60)

- May 2021 (127)

- April 2021 (122)

- March 2021 (156)

- February 2021 (154)

- January 2021 (133)

- December 2020 (126)

- November 2020 (159)

- October 2020 (169)

- September 2020 (181)

- August 2020 (147)

- July 2020 (172)

- June 2020 (158)

- May 2020 (177)

- April 2020 (188)

- March 2020 (234)

- February 2020 (212)

- January 2020 (164)

- December 2019 (107)

- November 2019 (131)

- October 2019 (145)

- September 2019 (123)

- August 2019 (112)

- July 2019 (93)

- June 2019 (82)

- May 2019 (94)

- April 2019 (88)

- March 2019 (78)

- February 2019 (77)

- January 2019 (71)

- December 2018 (37)

- November 2018 (85)

- October 2018 (108)

- September 2018 (110)

- August 2018 (135)

- July 2018 (140)

- June 2018 (118)

- May 2018 (113)

- April 2018 (64)

- March 2018 (96)

- February 2018 (82)

- January 2018 (92)

- December 2017 (62)

- November 2017 (100)

- October 2017 (105)

- September 2017 (97)

- August 2017 (101)

- July 2017 (104)

- June 2017 (155)

- May 2017 (135)

- April 2017 (113)

- March 2017 (138)

- February 2017 (150)

- January 2017 (127)

- December 2016 (90)

- November 2016 (135)

- October 2016 (149)

- September 2016 (135)

- August 2016 (48)

- July 2016 (52)

- June 2016 (54)

- May 2016 (52)

- April 2016 (24)

- October 2014 (8)

- April 2012 (2)

- December 2011 (2)

- November 2011 (10)

- October 2011 (9)

- September 2011 (9)

- August 2011 (3)

Calendar

Recent Posts

- Landlords devote 31 hours of ‘sweat’ every month to property management

- Social housing landlords urged to be fair on pet requests

- Derby landlord sells his portfolio with no searches, no survey, and £30,000 more than investor market

- Council urges landlords to help amid housing emergency in Scotland

- Government ramps up campaign to prepare landlords for Making Tax Digital

admin

admin