Derelict pub converted into a flat, modern HMO and commercial unit

In this case study, learn how long term Shawbrook Bank customer HMO Property Investments Ltd used finance to transform a derelict pub into a thriving new mixed use property in Lincoln, with Shawbrook Broker and Property118 Partner Brooklands Commercial Finance acting as intermediary.

If you are considering a refurb, development or commercial project it is definitely worth watching the video below to see how one of our favourite banks helped the clients with Bridging facilities and then switching straight to a term mortgage.

If you require assistance with any type of property finance from Buy to Let mortgages, commercial mortgages, Development finance and Refurbs to Bridging finance for investors and developers please complete the contact form below and we will be pleased to get our team at Brooklands Commercial finance to help.

jQuery(document).bind(‘gform_post_render’, function(event, formId, currentPage){if(formId == 209) {} } );jQuery(document).bind(‘gform_post_conditional_logic’, function(event, formId, fields, isInit){} ); jQuery(document).ready(function(){jQuery(document).trigger(‘gform_post_render’, [209, 1]) } );

The post Derelict pub converted into a flat, modern HMO and commercial unit appeared first on Property118.

View Full Article: Derelict pub converted into a flat, modern HMO and commercial unit

Advice – Tenants subletting on AirBnB

It appears I had a tenant subletting my property for bed and breakfast on AirBnB.

I recently had a battle to evict a tenant that ran the duration right up until bailiff attendance. The property was let through a letting agent. The story was that the guy was splitting from his wife and leaving the marital home (owned) and needed a place fairly local. He rented a 4 bed from me so that his children would be able to stay over. The guy produced bank statements showing 70+k in his account as he was a self-employed tree surgeon and his books didn’t reflect his earnings accurately. All other references checked out.

I got a bit uncomfortable during the stage when negotiating the initial AST rent, he seemed quite aggressive. I got even more worried when he failed to attend the agent’s office to collect the keys but made some excuse and asked if he could collect them from us after hours. A car with 4 Chinese people turned up on our doorstep at gone 8.30 pm asking for the keys. On calling the letting agent on his mobile he explained it away as his wife collecting the keys for him.

Later, after the initial 12 months the agent broached the matter of a rent review which was met with fierce resistance, so advised the agent I wasn’t comfortable with his general attitude and to serve a S21. The minute this was done he phoned the branch manager and was arguing aggressively; during that conversation he completely changed tac. He immediately revealed his knowledge about eviction procedure and told the agent he wasn’t moving out without bailiffs. No further rent was received from then on, it turned out he had never changed the bills into his name, he was switched to a key meter 3 months before final eviction but had never topped up (later found the electric bypassed), socket faces removed and extension leads hard-wired in etc. etc.

The long and the short is that he owed far more than the deposit covered in arrears, costs and damages. Fortunately I had rent guarantee insurance to mitigate the arrears but am having to go through Small Claims Court for the rest.

After bringing the property back up to standard, we secured a new tenant and the property is let once again.

Tonight we received a message from the tenant stating that someone had turned up on the doorstep claiming to have booked bed and breakfast and got very grumpy when turned away, claiming that he had stayed there before.

With this knowledge I Googled bed and breakfast in Basingstoke; AirBnB popped up, so I zoomed in on the map and low and behold there was a room advertised for £27 a night right where my property would be. The description made note that the address had changed. There was even mention of the tenant in the feedback comments, so I opened up the cached pages and there it was, my property address was actually mentioned in the advert. From reading the comments it appears that the pair of them are doing this across a number of properties in the south and London.

What should I do? Involve the Housing Officer at the Council? Is there legal action that I can take? Is Police intervention required? Should I involve Inland Revenue? Is there any action I can take via Small Claims Court?

Any advice would be greatly appreciated.

Thank you

André

The post Advice – Tenants subletting on AirBnB appeared first on Property118.

View Full Article: Advice – Tenants subletting on AirBnB

LSE call on Chancellor to reform Stamp duty

The London School of Economics and the VATT Institute for Economic have produced a research paper predicting the level of home moving would increase by 27% if the Stamp duty levy was completely abolished.

The research indicates current levels of stamp duty are making the housing crisis worse by cause a bottleneck in the market with pensioners being deterred form downsizing by the costs and stalling families from purchasing larger homes.

The Chancellor Philip Hammond is reportedly under pressure from his own Cabinet to reform Stamp Duty to kick start the market, which is also a major contributor to the wider economy. It is thought from a previous reform that if you halved the tax then income to the treasury would actually increase.

Co-author of the report, Professor Christian Hilber, said: “The key message of our paper is that stamp duty hampers mobility significantly.

“If you are a young family and you have an additional child, you’ll need an additional room, but the stamp duty is discouraging this kind of move because of the additional cost and lack of available homes to move into.

“In a nutshell, the stamp duty discourages the elderly from downsizing and young expanding families from moving to more adequate larger housing.”

Former chancellor, Lord Lawson of Blaby, told the Telegraph: “The present levels of stamp duty are clearly counterproductive, in terms of housing policy and revenue alike, and need to be reduced. For what it’s worth, when I was Chancellor, I halved the rate of stamp duty on house sales, and the revenue increased.”

HM Treasury replied saying: “Almost 90% of people want to own a home, but only 63% do. We reformed property taxes including stamp duty to help more people get onto the property ladder.

“In addition, we are helping people, including young families, to buy their first homes through policies such as Help to Buy and the Lifetime ISA, and the recent £2.3bn Housing Infrastructure Fund which will free up over 100,000 properties in high demand areas.”

| Purchase price of property | Rate of Stamp Duty | Buy to Let/ Additional Home Rate |

|---|---|---|

| £0 – £125,000 | 0% | 3% |

| £125,001 – £250,000 | 2% | 5% |

| £250,001 – £925,000 | 5% | 8% |

| £925,001 – £1.5 million | 10% | 13% |

The post LSE call on Chancellor to reform Stamp duty appeared first on Property118.

View Full Article: LSE call on Chancellor to reform Stamp duty

Are you properly alarmed?

Smoke and Carbon Monoxide Alarm Regulations:

From 1 October 2015, the law changed regarding smoke and carbon monoxide (CO) detectors and you may need reminding of the regulations as they now stand.

From that date, landlords in England are required to have fitted smoke detectors (alarms) on each storey of a rental property. CO detectors are also required in rooms where solid fuel appliances (e.g. those containing an open fire or log-burning stove) are installed.

Although not a legal requirement in the case of gas appliances, the Department of Communities and Local Government (DCLG) has said that it would expect and encourage reputable landlords to ensure that working CO alarms are installed. Landlords with properties in England must now fit these devices and not wait for the start of a new tenancy. Heat detectors designed for kitchens cannot be a substitute for smoke alarms.

Since 1 June 1992 Approved Document B (Fire Safety), which supports the Building Regulations (England and Wales) 2010, has required all new build properties to have hard- wired smoke alarms on at least each storey of the property. However, until now there was no requirement to have smoke alarms in older and non-licensed dwellings.

New requirements

At least one smoke alarm must be installed on each storey of a rental property used as living accommodation, and a CO alarm in any room containing solid fuel appliances that is used as living accommodation. After that, the landlord must make sure the alarms are in working order at the start of each new tenancy. Note: in the DCLG’s view, for the purpose of these regulations, a mezzanine floor would not be considered a storey.

In general, smoke alarms should be fixed to the ceiling in a circulation space, i.e. a hall or a landing, and CO alarms should be positioned at head height, either on a wall or shelf, approximately 1‒3m away from a potential source.

The immediate landlord (or someone acting on their behalf) must test the alarms on the first day of a new tenancy, ideally with the tenant/s present. Tenants should be advised to take responsibility for their own safety and test all alarms regularly to make sure they are in working order; testing monthly is generally considered an appropriate frequency.

The first day of the tenancy is the date stipulated in the agreement, even where the tenant decides to actually move into the property on a later date. A new tenancy is one commencing after the 1 October 2015, not a continuation of an existing tenancy before that date.

In cases where tenants refuse access for alarm fitting or testing, the landlord should write to them, with a copy to the local authority, explaining that it is a legal requirement to install the alarms and that it is for their own safety.

The regulations do not stipulate the type of alarms (such as hard wired or battery powered) to be installed. Landlords should make an informed decision and choose the best alarms for their properties and tenants, but it is recommended that 10-year guarantee lithium battery or hard-wired alarms are installed in pre-1 June 1992 properties.

The regulations will apply to any tenancy, lease or licence (not lodgers living with a landlord and family) of residential premises in England, that gives somebody the right to occupy all or part of the premises as their only or main residence, in return for rent. There are some exemptions, such as for long leaseholds and social housing landlords.

Documentary evidence

Landlords and/or their managing agents should ensure that they have documentary evidence that the alarms are tested and in working order on the first day of a tenancy, for example, by the tenant signing a copy of an inventory. Failure to comply with these regulations would mean the local housing authority can levy a civil penalty charge of up to £5,000 on the landlord, but there is a right of appeal.

Landlords and managing agents are encouraged to ensure tenants’ safety and provide documentary evidence of this by carrying out basic risk assessments covering fire, gas, electrical, Legionella and general safety inside and outside the property between each tenancy.

Regulations vary throughout the UK and there is some overlap. This is a brief summary:

Wales: The new regulations do not apply here, but similar rules are expected soon. Currently, properties in Wales built post-1992 must be fitted with mains-powered, interlinked smoke detectors/alarms, but landlords are advised to provide at least battery-operated alarms in older properties. Houses in multiple occupation (HMOs) are required to have hard-wired alarms fitted.

In England and Wales there is also a duty under the Part J of the 2010 Building Regulations for England and Wales to have CO alarms fitted when a solid fuel heating system is installed – Building Regulations 2010 – Combustion Appliances

Scotland: The mandatory fitting of CO alarms in private rented property became law on 14 May 2014 under the Housing Scotland Act 2014 (http://bit.ly/VPf2dJ). Besides existing gas safety regulations, the act prescribes that there must be “satisfactory provision for giving warning if CO is present in a concentration hazardous to health”.

This means that it is now mandatory for private landlords to install CO detectors in every space containing a ‘fixed combustion appliance’ (excluding those used solely for cooking) and where a flue passes through high-risk accommodation, such as a bedroom or main living room.

On 1 December 2015, new regulations came into force regarding the provision of long-life CO alarms in privately rented housing. This addition to the Housing (Scotland) Act is an amendment to the existing Repairing Standard that firmly shifts the duty of care regarding the provision and replacement of CO detectors to landlords. The legislation applies to all landlords in Scotland renting out property with fixed combustion appliances of any kind, with the exception of those used exclusively for cooking.

Fire safety (smoke alarms) revised guidance in Scotland www.prhpscotland.gov.uk makes it mandatory that one fire and smoke detector alarm is fitted:

- in the room most frequently used by the occupant(s) for general daytime living purposes

- in every circulation space (halls and landings)

- on each floor of a building

- in every kitchen.

All alarms must be integrated.

Northern Ireland: Technical Document L of the Building Regulations in Northern Ireland states: “Where any combustion appliance is installed, reasonable provision must be made to detect and give warning of the presence of CO gas at levels harmful to people. The authority for this is that landlords of private rental properties (that are not HMOs) are required, within reason, to ensure that the property they let is ‘safe and would not cause injury or death to humans or pets’.” Landlords must therefore be able to prove due diligence in a court of law should a fire occur at the property.

The Northern Ireland Fire and Rescue Service (NIFRS) recommend that the standards of fire safety in private rental properties should be at least equivalent to the current fire safety standards expected in a modern domestic property. Therefore, landlords renting a private property should at least provide working smoke alarms (preferably interconnected) on each level of the property and detection in the principal habitable room, considered to be the main living room, and a heat detector and fire blanket in the kitchen area.

Guidance concerning smoke and CO alarms is available from the NIFRS at: www.nifrs.org/fire-safety/community-information-bulletins

The Smoke and Carbon Monoxide Alarm (England) Regulations 2015

©1999 – Present | Parkmatic Publications Ltd. All rights reserved | LandlordZONE® – Are you properly alarmed? | LandlordZONE.

View Full Article: Are you properly alarmed?

Can investors still make money from Buy to Let

Can investors still make money from investing in buy to let property with all the restrictions that have been placed on the industry?

In the recent budget announcement (2016) landlords could quite easily be left with a feeling that they have been targeted because of the previous Mortgage tax relief changes and investor Stamp Duty. Investors can no longer claim tax relief on all their mortgage interest payments, which means that if previously they were making a net profit of £10,000 per annum but was paying £5,000 in mortgage interest costs, they could wipe that off and only pay tax on the remaining £5,000. The changes mean that higher-rate taxpayers whose mortgage interest costs make up 75% or more of their rental income will see their profits completely wiped out.

It is understandable that both new and seasoned investors alike might be put off from investing in property. There are various solutions available that can help you maximise profits and ensure that you are getting the best value for money. Below are some suggestions that can help you make money in the buy to let property market.

Reduce the cost of purchasing a property

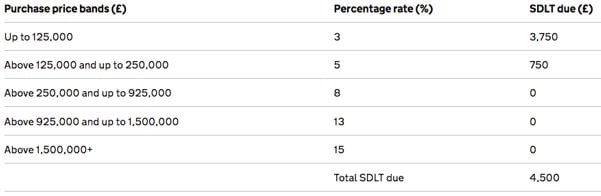

In April 2016 additional stamp duty charges were announced, which means that landlords must pay an extra 3% in stamp duty charges. With average house prices in the north west at £186k and west midlands at £213k according to Rightmove’s House Price Index, on a buy-to-let investment of £140,000 that means a whopping £4,500 in Stamp Duty.

https://www.tax.service.gov.uk/calculate-stamp-duty-land-tax/#/detail

Understandably, this has deterred investors from considering buy-to-let property, however there are alternative options that allow investors to mitigate their loss. Commercial property investments such as Care home investments and student property investments with values under £150,000, have NO stamp duty. Several investors are realising the benefits of these opportunities because the savings on Stamp Duty increases their yield on cost and ultimately the return on investment. Individuals have the potential to save thousands of pounds, simply by reconsidering the asset type they choose to own.

Research the most suitable areas for the asset class

The best areas for investment can be dependent upon the type of property you are wanting to purchase. For example, a sleepy town in the south west of England might be perfect for a care home investment, but not so suitable for a student accommodation investment.

For buy to let investments specifically, you should weigh up each area’s credentials in terms of its demographics, regeneration projects, vicinity to large cities (or whether the development is in a large city itself), transport links, employment options and comparable developments in the area. This research can be time consuming and for busy working professionals they find they cannot always afford the time to conduct such extensive research. Many employ the help of an investment company who have taken the leg work out of the research and who can provide guidance to investors.

Know the realistic rental yield that can be achieved

Achieving a good rental yield is a fine balancing act. For example, in London house prices are high so the average rental yield is around 4.4%. Compare that with the North West where property is typically cheaper and you are looking at returns of 6.4% on average, and according to Rightmove’s Rental Trends Tracker, Liverpool can achieve some of the highest yields in the country at 6.7%. This is all a balancing act though, as if you choose to buy a property at a rock-bottom price you may find that there is very little demand for the property, or that the rent generated from the property’s occupancy is disappointing. According to LendInvest, other areas that investors can expect a high yield include Peterborough, Stevenage and Rochester.

This leads us perfectly to our next point, which can have a knock-on effect with regards to how much rent per calendar month you can charge tenants.

Choose buy-to-let investments in areas experiencing regeneration

Investing in property in an area experiencing regeneration has many benefits, and one if which is that property prices are still reasonable but are predicted to increase in value once the regeneration is complete. This allows investors to either increase rent after a set period which has a knock-on effect on the annual rental yield, but it also means that they can sell on the property at a higher price, resulting in good capital uplift. The benefit of investing in an up-and-coming area is the increase in demand from young professionals, looking to move to the area in pursuit of fresh opportunities and jobs. Over the past twenty years, two London boroughs that have been particularly appealing to young professionals – Hackney and Haringey – have experienced the highest growth in terms of house prices at 749% and 544% respectively. They have all experienced regeneration and gentrification too, due to young professionals being priced out of the more expensive Shoreditch area.

Consider the condition of the property

Beautiful Georgian and Victorian buildings capture the hearts of most people. However, they are more likely to need significant repair work and care to make them attractive to the rental market. The cost that goes into renovating the development could seriously deplete profit margins, and may mean that the landlord will have to check up on the property and make improvements more often than with a new build. A building requiring a lot of maintenance will not only affect the rental yields, but also will mean that the investor would have to invest a significant amount of time to the property’s upkeep.

One Touch Property can help you take a decision on what would work best for your financial expectations. Whether it be a buy to let property investment or a different asset class, One Touch Property offers different types of investments to suit every individual’s needs.

jQuery(document).bind(‘gform_post_render’, function(event, formId, currentPage){if(formId == 403) {} } );jQuery(document).bind(‘gform_post_conditional_logic’, function(event, formId, fields, isInit){} ); jQuery(document).ready(function(){jQuery(document).trigger(‘gform_post_render’, [403, 1]) } );

The post Can investors still make money from Buy to Let appeared first on Property118.

View Full Article: Can investors still make money from Buy to Let

Lost deeds from 1956?

A solicitor has been holding the deeds to my father in laws house since 1956. He has now moved into a nursing home so there is now a need to put it on the market and sell it.

However, it now turns out the solicitor could not find the deeds and they say they gave them to a third party in 1978 who was negotiating a £3000 advance. This person cannot be found and solicitor has no proof of releasing Deeds.

Land registry will not give full title deeds only possessory title because of this and the solicitor refuses to except any responsibility for loss are there any other avenues other then taking legal action open to us.

Many thanks

Steve

The post Lost deeds from 1956? appeared first on Property118.

View Full Article: Lost deeds from 1956?

Oakwood House – Sheffield student accommodation opportunity

Oakwood House is a new student accommodation investment development in Sheffield. Home to over 63,000 students and located nearby to both universities’ campuses, good occupancy levels are expected and a 8% rental income is assured for 3 years.

Sheffield is home to a significant student population as many are attracted to the city due to its affordability, buzzing nightlife and top tier universities. Currently, there are over 60,000 students studying in the city, split between the University of Sheffield and Sheffield Hallam.

Oakwood House seeks to offer luxury living for the modern student in the city. The development consists of 102 units over 5 floors, housed in two separate buildings. Sheffield’s major attractions, university campuses and shopping facilities are just a short walk or tram ride away – attractive to the discerning student who does not want to spend time and money traveling large distances to their lectures and seminars. The development is also conveniently located next to a Tesco and a five-minute walk from Sheffield’s main train station.

Shared spaces include kitchens, dining rooms and communal lounges. These come fully-equipped with state of the art features such as flat screen TVs.

Oakwood House Investment Fundamentals

- Purchase an apartment from just £57,950

- Assured rental yield of 8% for three years

- Fully managed, hands-off investment

- Fully furnished en-suite studios within walking distance of both university campuses

Why Invest in Student Accommodation?

A lot of investors are attracted to the idea of student property due to its easy maintenance. Developments are often fully managed, which is ideal for the overseas investor or busy individual who does not have the time to oversee its day-to-day running. These types of investments are becoming more and more popular, and Knight Frank estimates the purpose-built student accommodation market to be worth £46bn. The largest transaction was the purchase by the property arm of Temasek of a portfolio of 25 student buildings in various cities including London and Manchester. Hiew Yoon Khong, chief executive of Mapletree (Temasek’s real estate section), commented “Student accommodation is a big business and relatively low risk.”

Students are evidently willing to pay for good quality housing, which allows investors to achieve excellent yields. According to research by Knight Frank, over a fifth of students are willing to pay over £160 per week if the facilities impress them. Features most discerning students seek out include having an en-suite bathroom and a range of communal spaces – both of which Oakwood has.

For further information please complete the contact form below.

jQuery(document).bind(‘gform_post_render’, function(event, formId, currentPage){if(formId == 403) {} } );jQuery(document).bind(‘gform_post_conditional_logic’, function(event, formId, fields, isInit){} ); jQuery(document).ready(function(){jQuery(document).trigger(‘gform_post_render’, [403, 1]) } );

The post Oakwood House – Sheffield student accommodation opportunity appeared first on Property118.

View Full Article: Oakwood House – Sheffield student accommodation opportunity

PRA and Section 24 changes and what they mean for property investors

How will lenders, brokers and investors alike be affected now and in the future by ongoing tax changes with Section 24 mortgage interest relief restrictions now being phased in and the PRA’s final wave of BTL underwriting standards, coming into effect on 30th September 2017?

You can watch Shawbrook Bank’s Head of Sales Sarah Woolf, property investor Kim Stones and Laura Rodriquez from Property118 partner broker Brooklands Commercial Finance discuss these controversial issues in the video below.

If you require assistance with any type of property finance from Buy to Let mortgages, commercial mortgages, Development finance and Refurbs to Bridging finance for investors and developers please complete the contact form below and we will be pleased to get our team at Brooklands Commercial finance to help.

jQuery(document).bind(‘gform_post_render’, function(event, formId, currentPage){if(formId == 209) {} } );jQuery(document).bind(‘gform_post_conditional_logic’, function(event, formId, fields, isInit){} ); jQuery(document).ready(function(){jQuery(document).trigger(‘gform_post_render’, [209, 1]) } );

The post PRA and Section 24 changes and what they mean for property investors appeared first on Property118.

View Full Article: PRA and Section 24 changes and what they mean for property investors

Am I entitled to a refund

Hi Guys – I have been a tenant in this property for 2.5 years – I was just coming up to my tenancy renewal – when I was informed that the landlord will be selling, I was then served with a section 21 notice .

I have now been told that I need to be out of the property by the 25th Sep

In the area where I live rental properties are very very hard to come by – I have now found something I like.

I spoke with the agency – who verbally told me that the LL would be happy for me to vacate the property on the 18th of August – I totally forgot to get this in writing. Based on what was discussed over the phone, I have told my new landlord I could move in by the 11th August – and hand the keys back (after a professional clean ) on the 18th has agreed above.

I have now emailed the the agent, and have been told that the LL is unhappy about this and will not be refunding me for the rest of the month 18th – 25th this should be around £430.

Am I able to get a refund or would this be dead in the water – I have honestly loved living there and have been quite frankly a model tenant – in fact I would buy the place if he wasn’t asking a crazy amount for the place.

Any help or advice on what to go back with would be great

Thank you so much

Zozo

The post Am I entitled to a refund appeared first on Property118.

View Full Article: Am I entitled to a refund

Did Buy-to-Let landlords cause the housing crisis?

Media reports have long blamed landlords for causing the UK’s housing crisis, a phenomenon that is by no means confined to the UK. You only need to look at events in the Irish Republic, Australia, New Zealand, Canada, and the USA to see that rising asset prices have had the same effect across the world, and this has hit first time buyers the hardest.

That did not stop the UK Government’s assault on UK landlords, with a series of tax hikes that have hit the sector hard, driving some to leave the buy-to-let market for good. The Government’s clear intention according to Peter Armistead, a property investor in South Manchester, was to reduce BTL profits and contract the market, in an effort to stabilise house prices and help first time buyers onto the property ladder.

The big question is, says Mr Armistead, will this strategy work, or have landlords simply been used as a scapegoat for the housing crisis?

According to former Bank of England economist, Professor David Miles, the buy-to-let assault has been ‘profoundly wrongheaded’ and the government has wrongly blamed landlords for rising house prices and a shortage of new homes available to first-time buyers.

Professor Miles has said the government’s move to make buy-to-let less attractive than homeownership would serve only to push up rents and make it even harder for young people to save for a deposit.

Landlords and all second home owners have been hit hard by the introduction of a 3% surcharge in stamp duty payable on buy-to-let purchases from April last year, together with a staggered reduction in the tax relief on mortgage interest payments they can claim from April 2017.

Previously, landlords could deduct both mortgage interest and other allowable costs associated with a let property from their rental income, before calculating how much tax was due. This meant the income they had to declare to HMRC was much lower than their rental income, keeping their costs down and keeping many in a lower income tax bracket.

Since 6 April 2017, landlords have seen the amount they can write off for tax purposes drop by 25% each tax year until 2020, when they will have to declare all of their rent as income, pay income tax on the total and then claim back for 20% of it as a credit.

According to Peter Armistead, Managing Director of Armistead Property, although the government is trying to curb the buy-to-let market, property investment is robust in the long term.

Mr Armistead commented:

“It is estimated that two million Britons are now private landlords collectively renting out five million properties. With rising demand for rental property and a growing shortage of accommodation, the buy-to-let market will continue give a good return on investment.

“The good news for landlords is that while the new tax rules are challenging for most landlords, rising asset values and rental income will go a long way to protect profits.

“Landlords have plenty of options available that will help offset the increased taxation. The first thing landlords should do is carry out a serious portfolio review and work out how the tax changes and tougher mortgage lending will affect them and what options there are to save, or make more money. For example, mortgaging to get a better deal; renovating some old stock – these costs will be tax deductible; selling some properties; or increasing the rent.

“Landlords need to think outside the box and ask themselves questions like can I buy with cash or with far less leverage?; should I incorporate?; can I change a house into an HMO and increase the rental income?; can I get planning on an existing property to increase its value?; or can I add an extension, or convert the cellar?”

Peter Armistead has put together some options that landlords can consider to protect their profits:

- Review your properties and see if you can get planning on an existing property to increase its value, by adding an extension, or converting the cellars?

- If you have a one bedroomed property, can you make it into a small two bedroomed property?

- If you lack building skills/knowledge, but have equity or cash may be partnering with someone more skilled in building/renovation work would be profitable.

- Consider changing a house into an HMO and increase the rental income.

- There is a real shortage of properties right now and prices are at a record high so consider selling some stock.

- The tax changes don’t affect Limited Companies. Consider setting up a Limited Company and using this structure to hold your properties

- Are you an active or passive investor? Passive investors will get hit hardest by the changes. May be active investors can find deals for other investors and create income streams there.

- It will become far more important to buy property below market value. You can’t just buy £1 of property for a £1 anymore. Buying with a built-in discount will help ensure your investment is just that (i.e. an investment)

- Consider other specialist areas of property investment which compliment traditional BTL. For example, can you manage properties for other landlords and charge a fee for that service? Can you sack your lettings agent and do the job yourself or use a cheaper online lettings agent?

Author Peter Armistead is a property investor in South Manchester. He has developed and sold over 400 properties and has a portfolio of over 100 properties in Manchester.

©1999 – Present | Parkmatic Publications Ltd. All rights reserved | LandlordZONE® – Did Buy-to-Let landlords cause the housing crisis? | LandlordZONE.

View Full Article: Did Buy-to-Let landlords cause the housing crisis?

Categories

- Landlords (19)

- Real Estate (9)

- Renewables & Green Issues (1)

- Rental Property Investment (1)

- Tenants (21)

- Uncategorized (12,483)

Archives

- February 2026 (35)

- January 2026 (52)

- December 2025 (62)

- August 2025 (51)

- July 2025 (51)

- June 2025 (49)

- May 2025 (50)

- April 2025 (48)

- March 2025 (54)

- February 2025 (51)

- January 2025 (52)

- December 2024 (55)

- November 2024 (64)

- October 2024 (82)

- September 2024 (69)

- August 2024 (55)

- July 2024 (64)

- June 2024 (54)

- May 2024 (73)

- April 2024 (59)

- March 2024 (49)

- February 2024 (57)

- January 2024 (58)

- December 2023 (56)

- November 2023 (59)

- October 2023 (67)

- September 2023 (136)

- August 2023 (131)

- July 2023 (129)

- June 2023 (128)

- May 2023 (140)

- April 2023 (121)

- March 2023 (168)

- February 2023 (155)

- January 2023 (152)

- December 2022 (136)

- November 2022 (158)

- October 2022 (146)

- September 2022 (148)

- August 2022 (169)

- July 2022 (124)

- June 2022 (124)

- May 2022 (130)

- April 2022 (116)

- March 2022 (155)

- February 2022 (124)

- January 2022 (120)

- December 2021 (117)

- November 2021 (139)

- October 2021 (130)

- September 2021 (138)

- August 2021 (110)

- July 2021 (110)

- June 2021 (60)

- May 2021 (127)

- April 2021 (122)

- March 2021 (156)

- February 2021 (154)

- January 2021 (133)

- December 2020 (126)

- November 2020 (159)

- October 2020 (169)

- September 2020 (181)

- August 2020 (147)

- July 2020 (172)

- June 2020 (158)

- May 2020 (177)

- April 2020 (188)

- March 2020 (234)

- February 2020 (212)

- January 2020 (164)

- December 2019 (107)

- November 2019 (131)

- October 2019 (145)

- September 2019 (123)

- August 2019 (112)

- July 2019 (93)

- June 2019 (82)

- May 2019 (94)

- April 2019 (88)

- March 2019 (78)

- February 2019 (77)

- January 2019 (71)

- December 2018 (37)

- November 2018 (85)

- October 2018 (108)

- September 2018 (110)

- August 2018 (135)

- July 2018 (140)

- June 2018 (118)

- May 2018 (113)

- April 2018 (64)

- March 2018 (96)

- February 2018 (82)

- January 2018 (92)

- December 2017 (62)

- November 2017 (100)

- October 2017 (105)

- September 2017 (97)

- August 2017 (101)

- July 2017 (104)

- June 2017 (155)

- May 2017 (135)

- April 2017 (113)

- March 2017 (138)

- February 2017 (150)

- January 2017 (127)

- December 2016 (90)

- November 2016 (135)

- October 2016 (149)

- September 2016 (135)

- August 2016 (48)

- July 2016 (52)

- June 2016 (54)

- May 2016 (52)

- April 2016 (24)

- October 2014 (8)

- April 2012 (2)

- December 2011 (2)

- November 2011 (10)

- October 2011 (9)

- September 2011 (9)

- August 2011 (3)

Calendar

Recent Posts

- London rents climb as supply stays tight

- Landlords devote 31 hours of ‘sweat’ every month to property management

- Social housing landlords urged to be fair on pet requests

- Derby landlord sells his portfolio with no searches, no survey, and £30,000 more than investor market

- Council urges landlords to help amid housing emergency in Scotland

admin

admin