Airbnb – Overnight success or a bad night’s sleep?

Airbnb is fast becoming the preferred method of accommodation amongst leisure and business travellers. For Airbnb hosts it can be an easy way of making some extra cash.

However, recently there have been a number of cases where properties have been damaged by guests, sublet by tenants, people being injured at Airbnb properties and hosts left with a lot of clearing up to do.

Nicole Rogers from DAS Law answers the most important questions for existing Airbnb hosts and those thinking of renting out their properties.

Could sharing your rented or leasehold property with Airbnb cost you your tenancy or home?

Millions of Airbnb users may have unknowingly breached the terms of their leases, leaving them vulnerable to legal action or losing their tenancy.

The vast majority of tenancy and leasehold agreements are likely to state that the property in question may only be used as a private residence. This would prevent tenants from renting out or ‘sharing’ their flat or home for short periods. It should be considered by anyone letting their property out through Airbnb to check their tenancy or leasehold agreements first.

It is not just those renting that should be wary of breaking contracts, mortgage companies may also take a dim view of home owners offering short term lettings of their property. It would be wise for owners to contact their mortgage company before offering their home out, as they may very well be breaking their mortgage contract. Whilst buy-to-let mortgages allow for assured short term tenancy, ‘short-term’ is often defined as 6 months; clearly Airbnb stays are considerably shorter than this.

What precautions do you need to take to comply with health and safety legislation?

Hosts must ensure that the premises are reasonably safe for visitors. With regards to fire safety, landlords should inform visitors of a fire evacuation route. The Regulatory Reform (Fire Safety) Order 2005 makes landlords responsible for taking steps to protect the people using your premises from the risk of fire. This means that a host should carry out a fire risk assessment, if necessary, improve the fire safety measures and keep the risks, and fire safety measures, under review.

If a visitor has suffered an injury at a host’s premises, he/she may seek to pursue a personal injury claim, particularly if the host has breached its duty of care to the visitor, which subsequently has caused foreseeable injury.

If your property or belongings are damaged or stolen, will your home and contents policy cover you?

It is unlikely as the insurer will usually not have catered for paying guests when arranging the policy. The host would need to clarify with their insurer as to whether their cover would be sufficient to cover losses. Airbnb do offer a ‘host guarantee’ whereby the firm promises to reimburse hosts for damages of up to £600,000, the company adds that hosts should not consider this as a replacement for owners or renters home insurance.

Whilst a host is not required to take out specific landlord insurance, it would be advisable to speak with a specialist broker or insurer to ensure sufficient protection.

What are the tax implications for the income you receive?

Money received from hosting is generally regarded as income; therefore, it is likely that income tax will be payable so the host may need to declare their earnings to HMRC. It is possible that a host may be entitled to certain tax reliefs or allowances, so it is advisable to take tax advice regarding this.

As an Airbnb host, do you need to have public liability insurance?

There is no legal obligation to take out public liability insurance to host via Airbnb. However, it would be worthwhile to do so in order to protect yourself, the host in the event of an injury claim from the visitor.

The post Airbnb – Overnight success or a bad night’s sleep? appeared first on Property118.

View Full Article: Airbnb – Overnight success or a bad night’s sleep?

Trail of destruction by tenant from hell in Liverpool Echo

The Liverpool Echo have shown the flip side of the landlord story with a shocking tail of wilful destruction by a tenant from hell.

Click here to see the full article and terrible photos.

The Landlord is Steve Parry, a 55 year old surveyor, who bought two rental properties to supplement his pension and retirement planning. However, the plan went ‘Bad’ for his property in Wavertree Liverpool.

Steve said he had “not made a bean” after the nightmare last tenant who cost £1,500 in court fees to evict leaving more than £2,000 in unpaid rent and at least £6,000 in damages.

The Photos in the Echo show a ceiling that collapsed after a (assumed deliberate) flood in the bathroom, piles of rubbish including bags of dog mess, trashed kitchen and smashed doors.

Steve served notice on the tenant in 2015 as she fell behind with rent and had a large frightening dog that was prohibited under the tenancy agreement.

Steve, in his Echo article, reported: “The house was wrecked, it’s shocking. She had failed to sort the rent out despite numerous promises, so I gave her two months’ notice to quit.

“I was then forced to serve two notice on her, which cost £200 each and she ignored. I had to get an order for possession in court, which I only got in the November. She was supposed to vacate by the 13th December, but despite everything I let her remain on agreement she would leave after the New Year.

“But she refused to move, saying she was looking for a new house. I had no choice but to pay for court bailiffs. She was finally removed this April.”

It was then that Steve found the trail of destruction wrought on his house.

Steve said that although he knew it was unfair to tar all benefits tenants with the same brush, he also could not take the risk again, and knew many landlords were now choosing not to rent to tenants in receipt of benefits especially with Universal Credit reforms forcing tenants to manage their own benefit payments.

He went on to say “people assume you’re loaded as a landlord, but I haven’t made a bean I’ve had that many problems. All I’m hoping is the house value will be more than I bought them for.”

Steve’s final plea to the government was to continue to crack down on bad landlords, but to also redress the balance protecting good landlords from bad tenants.

The post Trail of destruction by tenant from hell in Liverpool Echo appeared first on Property118.

View Full Article: Trail of destruction by tenant from hell in Liverpool Echo

Twelve Must-Do things when Letting a Property

New Landlords:

Are you new to lettings, do you want to rent-out your own home for a time, or have you bought a buy-to-let and you’ve never let one before?

If you are really nervous about doing this for the first time you should think about using a good professional letting agent, one that’s qualified, and a member of one of the key professional associations: RICS, ARLA UKALA, NALS and NAEA etc.

Otherwise, you can save a lot of money by doing it yourself, but you must pay attention to a few absolute basics. If you don’t you could find yourself with a heavy fine, or you will be stuck with a bad tenant, unable to evict, not paying rent and wrecking our property.

This article applies primarily to English law. Although tenancy laws are similar in other jurisdictions, there may be significant differences. Always seek professional advice before making or not making important decisions.

- Make sure the property is safe – that there are no obvious hazards and that it complies with basic letting rules and regulations. It’s a really good idea to do a simple written risk assessment: www.landlordzone.co.uk/documents

- You need an Energy Performance Certificate (EPC) before you can market your property. These cost in the region of £100 and last for 10 years. They give an energy rating from A to F, and after April 2018 the overall property rating must be a minimum of E. You must issue a copy of this certificate to the tenant at the start of the tenancy and on renewal. www.landlordzone.co.uk/directory/suppliers-directory/energy-assessors-2

- Make sure you have any gas and electrical systems and appliances in the properly checked, and a Gas Safety Certificate issued by a Registered Gas Safe Engineer. Plus the gas appliances must be serviced annually. These certificates last for 12 months, and they must be current at the start of the tenancy, a copy must be issued to the tenant, and on renewal. www.hse.gov.uk/gas/domestic/faqlandlord.htm There is currently no legal requirement to have professional electrical checks and reports, but this is recommended.

- Smoke Alarms must be fitted on each level of the property, preferably in the stairwell, along with Carbon Monoxide (CO) detectors in rooms where there are solid fuel appliances – including open fires. The alarms / detectors must be tested at the start of every tenancy and tenants should have instructions to test and report faults during the tenancy – www.landlordzone.co.uk/information/are-you-properly-alarmed

- Make sure you have done Legionella checks, especially if the property has been vacant for a period – these are basic checks which can be part of the safety risk assessment – www.landlordzone.co.uk/information/legionella-and-landlords

- Issue your tenant with the latest version of the Government’s “How to Rent Guide”, a legal requirement: https://www.gov.uk/government/publications/how-to-rent This document can be served as a pdf. via email if a clause in your tenancy agreement allows for documents to be served by electronic means.

- Screening and Selecting Tenants. This is perhaps the most important thing you do to make sure you have a successful tenancy. Make sure you do property checks using this 20 point check-list provided by TenantVERIFY: “A 20 Point Checklist – TenantVERIFY® Recommended Checks” – https://www.tenantverify.co.uk/useful-documents.html

- Protecting Deposits. Since April 2017 all security deposits taken (maximum of one month’s rent) must be protected in one of the Government approved schemes and statutory information (section 213 notice) served on the tenants or any other person that paid the deposit. www.landlordzone.co.uk/content/importance-of-protecting-deposits

- Inventories. Since the advent of the Deposit Protection Scheme, without a good inventory you will not stand a chance of winning a claim against the deposit for damage to the property. You need documentary evidence to show before and after and ideally an independent inventory company should be used.

www.landlordzone.co.uk/landlordzone-update/attention-to-detail-in-inventories - The check-in. Checking-in a new tenant is a very important process. There a lots of things to remember, so it’s wise to have a check-list in front of you so you don’t forget anything important. Find the Check-in-Check-Out Checklist here: www.landlordzone.co.uk/documents

- Operating Instructions. You should supply a folder to new tenants with safety and operating instructions and emergency procedures for everything: how to operate the cooker, defrost the fridge, light fires, locate stop taps and electrical fuses, alarm settings etc. Also other information such as when and where the bins are emptied, where post should be forwarded to, and where the local amenities, entertainment, good pubs and restaurants, and transport routes are; this will always be appreciated.

- Administration. Don’t forget to record all your income and expenses for the year which will be needed for your annual self-assessment tax return. A simple spread sheet will do for this if you have just one or two properties, otherwise think about investing in one of the landlord software packages – www.landlordzone.co.uk/directory/suppliers-directory/software It’s a good idea to keep all the paperwork in one place relating to the property / tenancy and keep a journal which records all communications, dates, times and conversations with tenants.

©1999 – Present | Parkmatic Publications Ltd. All rights reserved | LandlordZONE® – Twelve Must-Do things when Letting a Property | LandlordZONE.

View Full Article: Twelve Must-Do things when Letting a Property

Recommended Accountants?

Does Property118 recommend any property specific accountancy firms? If so will these complete my self assessment along with providing me the best tax planning advice?

I am a young landlord at 27 with 4 rental properties and a full time job. I feel a little bogged down in the past 12 months regarding all the recent changes and confused about the best ways to go forward. I would love some personal advice tailored to my specific circumstances.

I really need to appoint an accountant asap who can guide my through my first self assessment and hopefully advise me on what’s the best approach going forward. Is there a one stop shop or will my accountant and tax planner be two separate entities? (This rings alarm bells for bills).

I’ve seen many of the posts the two mark’s post on here regarding incorporation but wonder if it’s relevant to me and my modest portfolio.

Any comments would be greatly appreciated.

Joe

jQuery(document).bind(‘gform_post_render’, function(event, formId, currentPage){if(formId == 25) {jQuery(‘#input_25_4′).textareaCount( { ‘maxCharacterSize': 3, ‘originalStyle': ‘ginput_counter’, ‘truncate': true, ‘errorStyle’ : ”, ‘displayFormat’ : ‘#input of #max max characters’ } );} } );jQuery(document).bind(‘gform_post_conditional_logic’, function(event, formId, fields, isInit){} ); jQuery(document).ready(function(){jQuery(document).trigger(‘gform_post_render’, [25, 1]) } );

The post Recommended Accountants? appeared first on Property118.

View Full Article: Recommended Accountants?

Send in tax returns even if you don’t make a profit

Unfortunately, we still speak with amateur landlords who may have owned a rental property for years, often by accident, who have not submitted any tax returns. This is most commonly because they think they don’t need to if they haven’t made a profit.

To be fair to HMRC if no profit hasn’t been made and you own up first they are pretty understanding about it.

However, Newham council are now working with HMRC investigating all landlords that are on their selective licencing list, but not declaring on self assessment tax returns that they own rental property. They think this could involve up to 13,000 landlords, which is about half the total number in the borough.

Sir Robin Wales, Newham Mayor, said: “In addition to uncovering large scale exploitation of vulnerable tenants, our licensing scheme has also unearthed that many unscrupulous landlords may be benefiting from undeclared tax.

“At a time when local authorities are experiencing savage cuts, and Newham alone has had half its grant funding cut, possible tax evasion on this scale takes money from vital public services. This is money out of the pockets of our poorest residents who rely on our services the most.

“While the Chancellor is scrambling around ahead of his Autumn Budget and the Prime Minister is claiming there is ‘no Magic Money Tree’, Newham has the solution in private rented licensing.“

University of London professor, Richard Murphy, claims that tax revenue losses from the PRS could amount to £1 billion per annum.

Murphy’s assessment is based upon the above Newham statistics and he said in his blog, “Their estimate is that maybe £200 million of tax is not being paid in London alone as a result of the failure of landlords to register to declare tax that they owe. This compares with HMRC’s suggestion that they may lose £550 million of tax a year in this way across the country as a whole.”

The post Send in tax returns even if you don’t make a profit appeared first on Property118.

View Full Article: Send in tax returns even if you don’t make a profit

HMO COUNCIL TAX being changed on each room!

Hi all, I have a bed HMO which consists of having all en-suites. I’ve been battling with the local Council reference council tax since obtaining planning permission and once fully finished. As all landlords know council tax is very expensive!!

The council classed the HMO rooms as “self contained”, however after having number of site visits and local planning enforcement on site valuation office classed the property as a HMO. Now Aug 2017 valuation office have wrote letters to all tenants stating they are liable for council tax and have billed me £14,000 due to seeing the plans before in 2014 and now they say there has been have been some ” alterations ” ( en-suite in rooms), which was done when planning was put in 2014.

The valuation office doesn’t know what they are doing after number of calls and messages they still not understand. Has anyone been thought this traumatic time ???

I await messages of how you overcame this situation.

Thanks

Rahul

The post HMO COUNCIL TAX being changed on each room! appeared first on Property118.

View Full Article: HMO COUNCIL TAX being changed on each room!

Bristol Slum Landlords Exploiting Migrants…

Rouge Landlords:

Slum landlords who have been exploiting migrants in shocking housing conditions are to be targeted by a new Bristol Council inspection team says the Bristol Post. The scheme to crack down on these landlords is being funded by central government.

The team aims to inspect thousands of privately-rented homes across the Bristol city. This comes after a whole host of “shocking conditions” have been exposed over the past few months by the Bristol Post.

Funding provided by The Home Office will be used by the Council – more than £320,000 – from a ‘Controlling Migration Fund’ to be used solely to tackle the “decrepit state” of many privately-rented homes and rooms in certain parts of the city.

Poor standards housing is a recognised issue across Bristol, but it is thought to be markedly worse in places with concentrated populations of migrants and refugees. Unscrupulous ‘rouge landlords’ are said to rely on the fact people who are relatively new to the country either don’t know they can complain about it, or are afraid to.

The council says that migrants are ‘over-represented in the private rented sector’ in Bristol. This is because they are at the bottom of the queue for council housing, often ending up in properties in poor condition.

Over the past year, the Bristol Post has exposed a housing crisis in the city. It has revealed stories such as that of the Somali woman whose neighbours of 12 years in Easton lined up to prevent a ‘revenge eviction’, instigated by here complaining about damp.

There was another shocking example with the death of Jorge Rias, a Colombian who died in a single room in a House in Multiple Occupancy (HMO) in St Paul’s that was so smelly, his body wasn’t discovered for weeks.

Recently the Post exposed how one landlord told another family from overseas, whose children have been born and grown up in Bristol, that they would be evicted after they complained of water pouring down walls when it rains.

Those kinds of anecdotal evidence are said to be multiplied countless times across the city. A situation that has prompted central government to fund Bristol to the tune of £321,750 for a two-year project to identify and target these rogue landlords, and where necessary to take enforcement action.

Bristol’s housing chief, Cllr Paul Smith has said:

“Across the city people are finding it increasingly difficult to access decent, affordable homes.

“In Bristol we are working hard to tackle criminal landlords and through this extra funding, we expect to see a reduction in the number of these criminal landlords letting out poor quality accommodation and exploiting tenants.

“Making sure that everyone in Bristol has a safe, comfortable place to call home, is one of our key priorities, and we are doing all we can to make this a reality. We intend to use all enforcement powers at our disposal where appropriate,” Cllr Smith added.

Controversy has surrounded the government’s ‘Controlling Migration Fund’ as it often leads to enforcement action being taken against people who are found to be in the country illegally.

The fund is actually split into two parts: one half is to tackle the illegal immigrants, and the second to help authorities assist those people who are here quite legally and this is where the money to target slum landlords is to come from.

The councils says that this money will pay for around 1,200 inspections of properties in Bristol.

©1999 – Present | Parkmatic Publications Ltd. All rights reserved | LandlordZONE® – Bristol Slum Landlords Exploiting Migrants… | LandlordZONE.

View Full Article: Bristol Slum Landlords Exploiting Migrants…

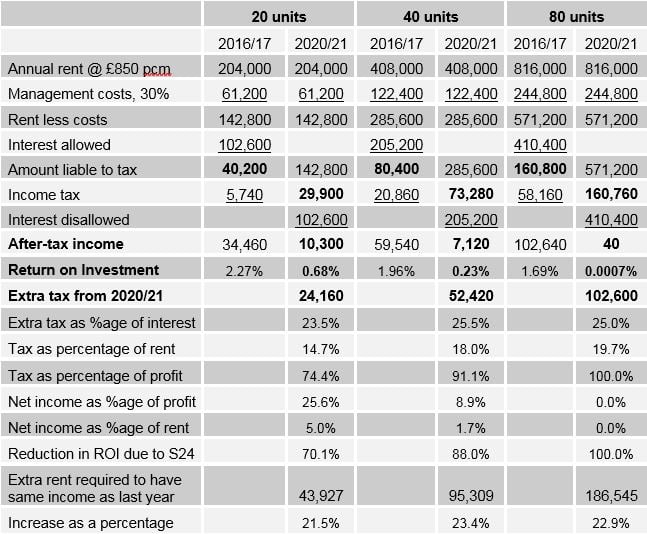

The paradox of Section24

Last week a reader pointed out that the gross yield figures that are bandied about are misleading and we should concentrate on the return on investment (ROI).

https://www.property118.com/using-net-rental-yields/

The gross yield is the annual gross rent as a percentage of the value of the property. The ROI is the after-tax profit as a percentage of the amount invested, basically the deposit where a mortgage is involved.

He did a calculation based on the following average figures: property price £190,000, rent £850 per month, loan 60%, interest rate of 4.5%,running costs which included full management or an employed team for the larger landlord like himself which costs 30% of the rent. He arrived at an ROI of 2.01%. The gross yield is 5.4%

The consensus was that ROI is much more useful. And somebody pointed out that we now have to take S 24 into account as it dramatically reduces after-tax profit where finance costs are incurred.

He asked readers to check his calculation. Using the above figures per unit I tried to calculate how many units he had in order to arrive at an ROI of 2.01%. Assuming that there were no joint owners, and he had no other income, the answer is nearer 40 than 20.

This calculation revealed a paradox. Normally you would expect a bigger portfolio to produce a bigger after-tax income in absolute terms, and this is what happened until last year. As the table shows, after tax income does not exactly double as the number of units doubles, but it grows from £34k to 60k to £103k

However, under S 24, after-tax income will go down in absolute terms as the size of the portfolio doubles, from £10k to £7k to almost nothing – 50p per property per year.

At 81 units the tax will exceed 100% of the real profit.

And at each size, the fictitious profit will rule out entitlement to any benefits.

The owner’s work will just be for the benefit of his tenants, his employees, his lenders and his government.

I then calculated what effect S 24 would have on ROI as from 2020/21 when it is fully phased in. At 20 units it will be reduced by seven-tenths. At 40 units it will be reduced by nine-tenths. At 80 units it will be extinguished.

The effect of Section 24 of the Finance (No.2) Act 2015 on different sizes of portfolio

The real profit figures are on the line “Amount liable to tax” in the columns headed 2016/17

The extra tax is about 45% on the interest, minus the 20% “relief”.

To avoid bankruptcy he needs to increase the rent. He should have started to do so before April when S24 began to be phased in. To maintain the same after-tax income as he had last year he will need to increase the rent by the above percentages before April 2020, from £850 to about £1,050.

It is not sufficient to increase rents by the amount of extra tax because the increase itself will be taxed at 45%.

I have assumed that his 30% management costs do not include any agents fees that would go up in line with rents. If there are, he will have to increase rents even more

The post The paradox of Section24 appeared first on Property118.

View Full Article: The paradox of Section24

A few questions on a development opportunity we have

Hello All!

My wife and I are pursuing a development plot nearby where we live in Manchester and I’d like to ask readers for their thoughts on a few issues.

We’d like to develop 1 or 2 properties on this site.

We currently own a couple of BTLs and our own home all of which are mortgaged. We have the cash to buy the site (unless it goes for well over the asking price) and we have also set up a property SPV in advance of this type of opportunity. Our questions:

- Ownership – should we buy the site personally or through a Ltd company? Can we transfer into company at later stage? What is stamp duty?

- Financing – should we use self build mortgage, development finance, what gearing? Is development finance as easy to get through company as personally? Would having some of our money covering the development costs make much difference? to either the rate or our overall lendability?

- What’d we do with profits? – take out? reinvest in more property? pay down lending? And what are tax considerations of each?

- What we’d do with properties? – We’re not sure whether we’d rent out, sell, or even possibly live in them?

- Tax management – capital gains, reinvestment, Stamp Duty. Do we pay tax if profits are reinvested in property through Ltd company?

Any thoughts on any of these issues and what advice we should be seeking would be most helpful.

Many thanks in advance.

All best

Andy

The post A few questions on a development opportunity we have appeared first on Property118.

View Full Article: A few questions on a development opportunity we have

Property fraudsters stealing homes

Home owners and buy-to-let landlords are being warned of a potential rise in property fraudsters activity. This is more prevalent during the summer house marketing season.

This alert comes from Midlands property lawyer Javed Ahmed who says that owners could find themselves conned out of hundreds of thousands of pounds by people who “clone” their identities and sell houses and flats out from under them.

Mr Ahmed, from Midlands law firm mfg Solicitors, is concerned there will be a rise in fraud over the summer – typically the busiest time for the property market – and said owners needed to act now to protect themselves.

The assistant solicitor said fraudsters operating across the region had even been known to fool estate agents and lawyers by posing as the owner of property and then managing to take out loans or mortgage the building without the real owner’s knowledge.

Mr Ahmed said:

“Property is usually the most valuable asset people will own and it’s a hugely attractive target for fraudsters who want to sell it and pocket the money.

“It is something people think will never happen to them but it is a very real threat and people here in the Midlands must guard against it.

“Those who are most at risk are people who rent out their property, or whose property is vacant.

“It’s particularly an issue for those who own the property outright without a mortgage but one of the best steps is for owners to arrange a restriction on their title to prevent the Land Registry registering a sale without the identities being verified…”

Ahmed says this is a process best taken care of by a professional to ensure every box is ticked.

Mr Ahmed has produced guidance on the issue which advises people on a variety of ways to protect themselves and their property. This includes:

- Ensuring the property is registered at HM Land Registry

- Be part of HM Land Registry’s monitoring service to ensure you are notified of any suspicious activity involving the property

- Updating the property address with HM Land Registry should it be sold.

Javed Ahmed, Assistant Solicitor can be reached at mfg Solicitors on 0845 55 55 321 or javed.ahmed@mfgsolicitors.com

Protect your land and property from fraud

Property Alert Service – Land Registry

©1999 – Present | Parkmatic Publications Ltd. All rights reserved | LandlordZONE® – Property fraudsters stealing homes | LandlordZONE.

View Full Article: Property fraudsters stealing homes

Categories

- Landlords (19)

- Real Estate (9)

- Renewables & Green Issues (1)

- Rental Property Investment (1)

- Tenants (21)

- Uncategorized (12,482)

Archives

- February 2026 (34)

- January 2026 (52)

- December 2025 (62)

- August 2025 (51)

- July 2025 (51)

- June 2025 (49)

- May 2025 (50)

- April 2025 (48)

- March 2025 (54)

- February 2025 (51)

- January 2025 (52)

- December 2024 (55)

- November 2024 (64)

- October 2024 (82)

- September 2024 (69)

- August 2024 (55)

- July 2024 (64)

- June 2024 (54)

- May 2024 (73)

- April 2024 (59)

- March 2024 (49)

- February 2024 (57)

- January 2024 (58)

- December 2023 (56)

- November 2023 (59)

- October 2023 (67)

- September 2023 (136)

- August 2023 (131)

- July 2023 (129)

- June 2023 (128)

- May 2023 (140)

- April 2023 (121)

- March 2023 (168)

- February 2023 (155)

- January 2023 (152)

- December 2022 (136)

- November 2022 (158)

- October 2022 (146)

- September 2022 (148)

- August 2022 (169)

- July 2022 (124)

- June 2022 (124)

- May 2022 (130)

- April 2022 (116)

- March 2022 (155)

- February 2022 (124)

- January 2022 (120)

- December 2021 (117)

- November 2021 (139)

- October 2021 (130)

- September 2021 (138)

- August 2021 (110)

- July 2021 (110)

- June 2021 (60)

- May 2021 (127)

- April 2021 (122)

- March 2021 (156)

- February 2021 (154)

- January 2021 (133)

- December 2020 (126)

- November 2020 (159)

- October 2020 (169)

- September 2020 (181)

- August 2020 (147)

- July 2020 (172)

- June 2020 (158)

- May 2020 (177)

- April 2020 (188)

- March 2020 (234)

- February 2020 (212)

- January 2020 (164)

- December 2019 (107)

- November 2019 (131)

- October 2019 (145)

- September 2019 (123)

- August 2019 (112)

- July 2019 (93)

- June 2019 (82)

- May 2019 (94)

- April 2019 (88)

- March 2019 (78)

- February 2019 (77)

- January 2019 (71)

- December 2018 (37)

- November 2018 (85)

- October 2018 (108)

- September 2018 (110)

- August 2018 (135)

- July 2018 (140)

- June 2018 (118)

- May 2018 (113)

- April 2018 (64)

- March 2018 (96)

- February 2018 (82)

- January 2018 (92)

- December 2017 (62)

- November 2017 (100)

- October 2017 (105)

- September 2017 (97)

- August 2017 (101)

- July 2017 (104)

- June 2017 (155)

- May 2017 (135)

- April 2017 (113)

- March 2017 (138)

- February 2017 (150)

- January 2017 (127)

- December 2016 (90)

- November 2016 (135)

- October 2016 (149)

- September 2016 (135)

- August 2016 (48)

- July 2016 (52)

- June 2016 (54)

- May 2016 (52)

- April 2016 (24)

- October 2014 (8)

- April 2012 (2)

- December 2011 (2)

- November 2011 (10)

- October 2011 (9)

- September 2011 (9)

- August 2011 (3)

Calendar

Recent Posts

- Landlords devote 31 hours of ‘sweat’ every month to property management

- Social housing landlords urged to be fair on pet requests

- Derby landlord sells his portfolio with no searches, no survey, and £30,000 more than investor market

- Council urges landlords to help amid housing emergency in Scotland

- Government ramps up campaign to prepare landlords for Making Tax Digital

admin

admin